Alex Cheong Pui Yin

30th November 2022 - 3 min read

Grab has announced that it is now collaborating with credit reporting agency CTOS to also extend its buy-now-pay-later (BNPL) service, PayLater by Grab, to non-active Grab users – effective immediately. On top of that, PayLater will also be enabled for in-store purchases at selected merchant partners.

In a statement, Grab said that “anyone can now apply to use PayLater postpaid and instalments”. This is in contrast with the previous arrangement for PayLater, where the service was offered selectively to eligible users based on factors like their Grab transaction history and activity on the app. In short, these details allow Grab to verify their credibility as responsible users.

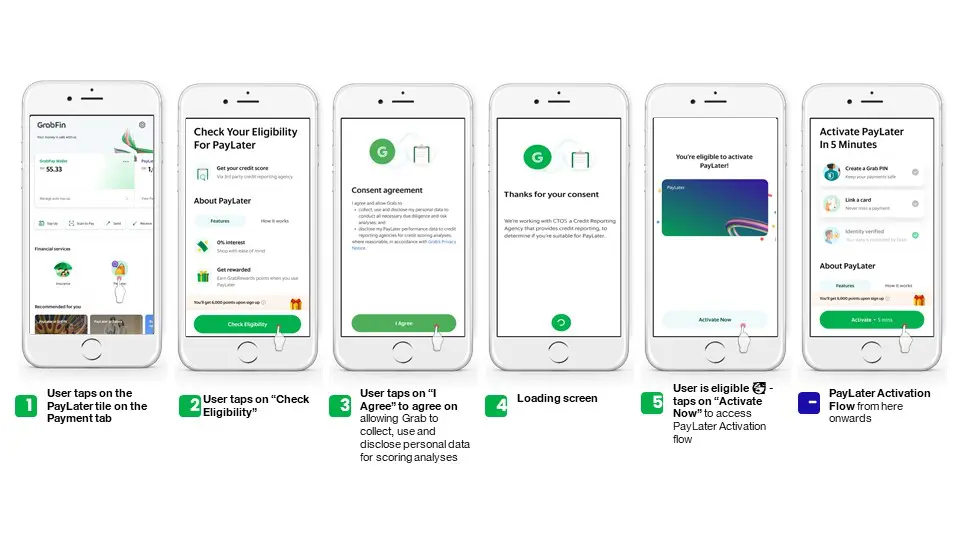

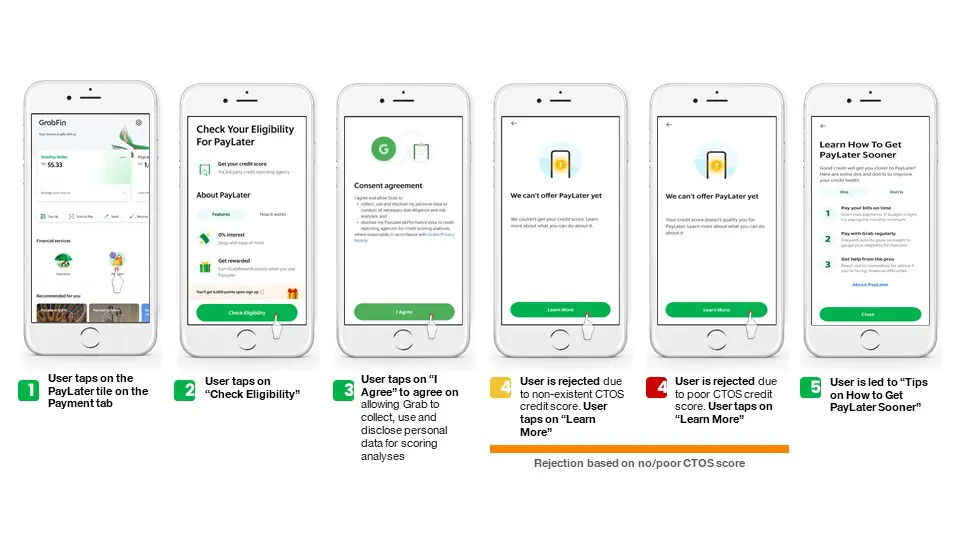

Now, any individuals who are interested to use PayLater can apply for the service by providing the necessary information to Grab via their app (provided that they have performed the standard electronic Know Your Customer (eKYC) procedure). CTOS will then conduct the required credit checks on them. If you pass the check, then you’ll receive a notification to activate PayLater. Meanwhile, those who do not will be alerted and given tips on how they can apply for PayLater with more success in the future.

Grab further explained that it will have permission to view users’ CTOS credit score when the checks are completed. Additionally, current PayLater users will not be impacted by the introduction of these credit checks by CTOS; the checks are only applicable for new PayLater applicants.

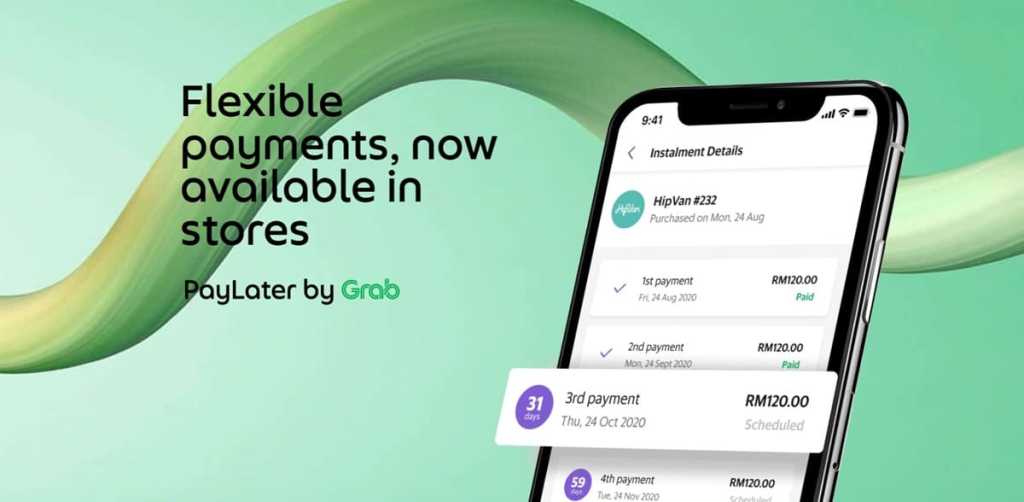

Aside from this, Grab is also extending the use of its PayLater to include in-store purchases at selected merchant partners; prior to this, PayLater was only available for online transactions. To tap into this new function, go ahead and present your Grab QR code to the cashier as usual. Once they scan your QR code, you’ll then have the option to select your preferred payment method, including PayLater.

Some notable brands that are already accepting Grab’s PayLater as a payment method for in-store purchases include ALL IT Hypermarket, Gamer’s Hideout, Li Ning, and OSIM.

Grab explained that these updates were introduced because it recognises the growing popularity of BNPL services at present. As such, the collaboration with CTOS will allow Grab to provide a convenient, flexible, and seamless BNPL payment method to an even larger user base. Additionally, people are once again shopping in stores, with Malaysia now having transitioned into the endemic phase of Covid-19. Therefore, expanding the use of PayLater to include in-store purchases also made sense.

Briefly, PayLater is Grab’s BNPL service that allows approved users to “postpone” the payment of their current purchases to a later date. You can either opt to pay the full amount at one-go in the following month, or split it into four monthly instalments.

(Source: Grab)

Comments (0)