Alex Cheong Pui Yin

22nd December 2020 - 3 min read

(Image: The Star)

Bank Islam has been crowned as Malaysia’s Strongest Islamic Retail Bank for 2020 by the Cambridge International Financial Advisory (Cambridge IFA) at the virtual 6th Islamic Retail Banking Award 2020. This is the second time that the bank has won the award, with the first being in 2015.

The chief executive officer of Bank Islam, Mohd Muazzam Mohammed said that the bank is thankful for the prestigious award as it acknowledges Bank Islam’s strong commitment in delivering its customers’ expectations. It also recognises the bank’s continuous focus in providing comprehensive and innovative shariah-compliant financial and banking solutions.

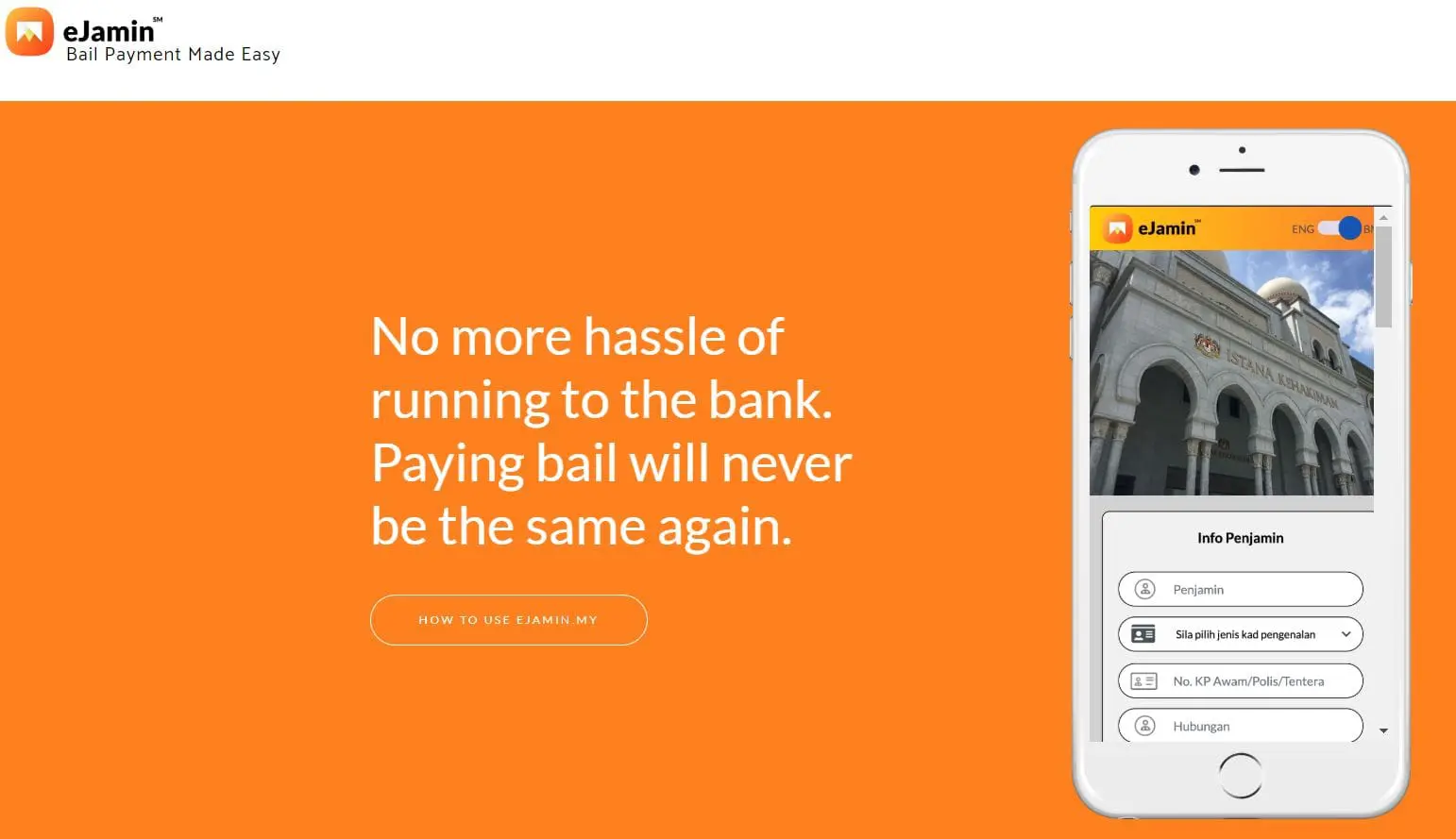

“We achieved many firsts in our 37-year history including the first issuance of Islamic sukuk in Malaysia and involvement in the digitalisation of Malaysia’s judiciary system via facilitating bailing process through the eJamin facility. The latest is the launch of BangKIT microfinance facility funded by sadaqah (donation), which is also the first-of-its-kind in the country. BangKIT, based on the qardhul hasan (profit-free) contract, is specially developed to finance selected unbanked and underbanked micro-entrepreneurs for them to start or broaden their small business,” said Muazzam.

On top of that, Muazzam commented that Bank Islam had embarked on a three-year strategic plan that focused on its digital banking initiatives. He said that it was a timely move as Covid-19 has accelerated the digital adoption among its customers, thereby changing the way Bank Islam does its business.

“Our mobile banking app, GO by Bank Islam had shown tremendous progress in a short period of more than 500,000 users – with an average growth of usage of 50% from March 2020 when the government enforced movement control order (MCO) to curb the spread of the pandemic. Between March to September 2020, more than RM2.4 billion in transaction amount was recorded through this app,” said Muazzam, adding that Bank Islam will be launching more services via the app so that customers can enjoy more convenience.

Muazzam further emphasised that Bank Islam’s strength is not determined solely by its financial accomplishments. Rather, it is also bolstered by the bank’s efforts in supporting the economy, community empowerment, as well as environmental protection. The bank has been proactive in assisting affected individual and business customers since the onset of Covid-19, offering financial aids such as the rescheduling and restructuring facility, as well as targeted and enhanced targeted repayment services.

(Image: The Malaysian Reserve)

“Malaysia’s Strongest Islamic Retail Bank for the year 2020 title also demonstrates Bank Islam’s readiness to become the first and only listed Islamic bank in Malaysia and the region. Hence, we will continue to innovate and deliver comprehensive financial solutions by leveraging the latest technological advancements to cater the need of a diversified portfolio of customers, at the same time continue to deliver value for our stakeholders,” said Muazzam.

The Islamic Retail Banking Award seeks to honours individuals and institutions that have significantly contributed to the growth and success of Islamic retail banking. It selects its winners based on an efficiency study conducted by Cambridge IFA, which ranks more than 130 Islamic retail banks.

(Sources: Bank Islam)

Comments (0)