Alex Cheong Pui Yin

27th May 2024 - 4 min read

Boost Bank has revealed that its deposit products will offer up to 3.6% p.a. daily interest, as it prepares for its upcoming launch as the third digital bank to go live in Malaysia on 6 June 2024.

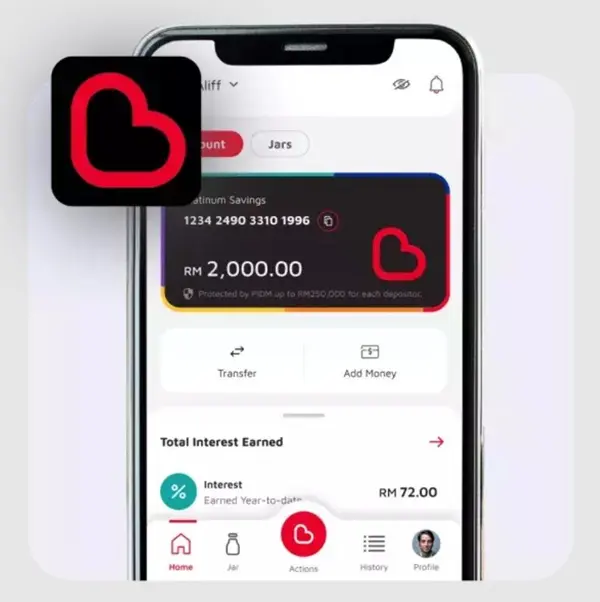

On its website, the bank highlighted that customers will be able to earn up to 2.5% p.a. daily interest on their funds in the savings account, whereas its Savings Jars – which is a goal-based savings feature – will offer up to 3.6% p.a. daily interest. Its T&C document, meanwhile, shared that the actual interest rates that you can enjoy for both products will be determined by a loyalty tier system; specifically, you need to rank up to Platinum President to enjoy higher interest, 3x Boost Stars and other exclusive benefits.

That said, the process to achieve and maintain the Platinum President status can be a little elaborate. According to the document, customers who deposit and reach a total of RM2,000 in their Boost Bank account for the first time will enjoy an automatic upgrade to the Platinum President status. For the remainder of this month where they first achieve the tier (referred to as Month 1), you do not need to maintain any specific balance. This status will also be kept for Month 2.

To retain the Platinum President status for Month 3, however, you’ll need to start putting in some effort starting in Month 2 itself. You are required to maintain a minimum daily balance of RM2,000 for at least 25 days within Month 2. If you do not meet this condition, your status will be downgraded back to the Basic tier at the start of Month 3, and you will lose your Platinum President privileges.

“Once a user has been downgraded from Platinum President to Basic, they can regain Platinum President status by maintaining a minimum end-of-day balance of RM2,000 for 25 calendar days within any calendar month. Upon meeting this requirement, their status will be immediately upgraded to Platinum President,” the bank noted in its document.

Aside from these info, Boost Bank’s T&C document also revealed that you’re allowed to create up to a maximum of eight Savings Jars at one time. Additionally, your account balance and transaction limitations will differ depending on how you opt to activate your Boost Bank account, as shown below:

As for fees and charges, Boost Bank noted that there is an annual dormant charge of RM10. This refers to accounts with no debit and/or credit transactions within a period of 12 months (dormant accounts).

Lastly, Boost Bank had posted a recent poll on its social media accounts where it invited followers to vote on the design of its upcoming debit card, choosing between a sleek black card with red logo (Team Black), or a vibrant red with a white logo (Team Red). Have a look at the two card faces, and if you want, share your thoughts as well!

Earlier this year, Boost Bank had already shared on its website that it will be offering a savings account, the Savings Jar feature, and a debit card to customers. No other details were revealed at that time, such as the interest rates for the deposit products, but interested users were invited to sign up and join a waitlist to be among the first to experience the bank at launch.

Aside from Boost Bank, Malaysia has two other digital banks that are already serving the public, namely GXBank and AEON Bank. Specifically, GXBank officially rolled out to the public in November 2023, whereas AEON Bank went live just last week, with its official launch held yesterday. The country is set to see the emergence of five digital banks in total.

Comments (0)