Alex Cheong Pui Yin

14th December 2023 - 2 min read

Digital bank GXBank has revealed that its debit card, the GX Card, will be rolled out to customers in January 2024.

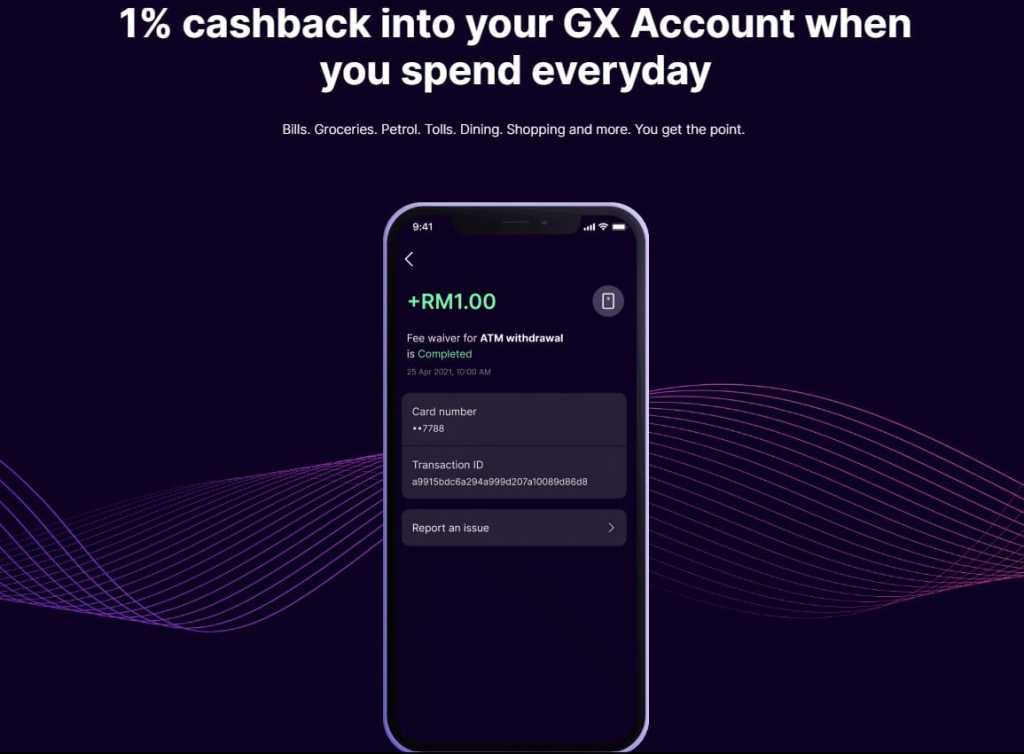

As we’ve reported previously, the card – which is to be available both as a virtual and physical card that is issued by Mastercard – will allow GXBank customers to earn unlimited 1% cashback when they use the card to make payments for a variety of online and offline expenses. These include bill payments, petrol, and groceries – including Jaya Grocer purchases (which already lets you earn up 1.5x GrabRewards Points for every RM1 spent).

Aside from that, those holding the GX Card will also be able to enjoy other perks like zero markups or fees on foreign transactions and a waiver on the RM1 MEPS ATM withdrawal fee nationwide. Do be aware that if you’d like to use the card for foreign transactions and payments while travelling abroad, you will need to first opt in for the function. This step is also necessary for card-not-present transactions, such as online transactions.

We’ve also previously shared that the GX Card will not be charged an annual fee, although there is a RM12 fee for the issuance of its physical card. There is also a 1.2% administration fee on the amount transacted in foreign currency or abroad via the GX Bank. These fees will, however, be waived until 31 December 2024.

GXBank officially commenced operations last month, rolling out its app and banking services to all Malaysians. Customers who open an account with the digital bank are able to earn daily interest of 3% p.a. on their savings, as well as tap into its Pockets feature to save for specific goals. There are also ongoing promos in conjunction with the introduction of the digital bank app that you can tap into, such as an instant cashback reward of RM20 when you add a minimum of RM100 to your GX Bank account.

(Source: GXBank)

Comments (0)