Alex Cheong Pui Yin

7th September 2023 - 3 min read

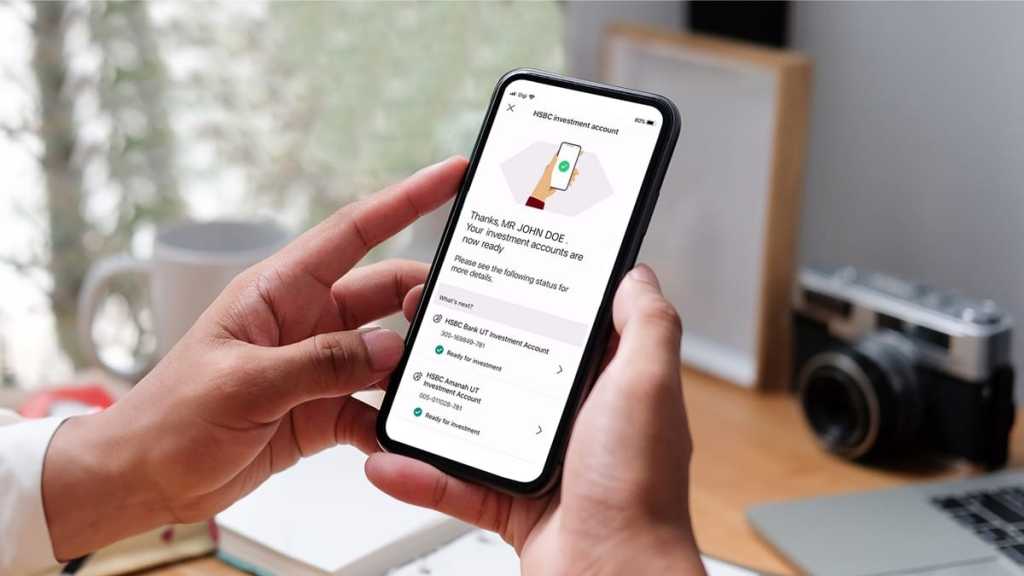

HSBC Bank has enabled a new feature on its HSBC Malaysia mobile banking app, which allows HSBC Premier customers to open investment accounts – namely for unit trusts, bonds, and sukuk – with the bank from the app itself. This makes HSBC the first bank in Malaysia to provide customers with the option to open bond and sukuk investment accounts via a mobile app.

In a statement, HSBC shared that the investment account opening service is embedded within the Wealth tab in the HSBC Malaysia mobile banking app, and it will allow you to open unit trust, bond, and sukuk accounts all at one go. The Wealth dashboard is also where customers can go to to monitor the performance of their various investments with HSBC, although it is currently not yet equipped to allow trading activities for bonds/sukuk. In order to buy or sell, you’ll still need to get the assistance of your relationship manager, either face to face or via Remote Engagement Service.

If you’d like to give this new feature a try, fire up your HSBC Malaysia mobile banking app and select “Wealth” (note that you must already have a savings or current account with HSBC before you can open an investment account with the bank on mobile). From there, tap on “Get Started”, after which you’ll be prompted to begin opening an investment account. Key in your details, if needed; otherwise, review your details and make sure that your information is up to date. Submit the application, and wait for your approval!

Country head of wealth and personal banking for HSBC Malaysia, Linda Yip said the introduction of this new account opening feature is in line with the bank’s ambition to become the leading wealth bank in the Asia.

“Digitalisation is a key part of our wealth business, as we continue to put customer convenience at the forefront, and the launch of the digital investment account opening service is a testament to this,” said Yip, adding that HSBC will use a hybrid model of relationship managers, wealth specialists, and digital wealth capabilities to serve its customers holistically.

Prior to introducing this latest digital investment account opening service on the HSBC Malaysia mobile app, HSBC had already rolled out the web browser version of the feature back in May 2022 on the HSBC online banking website. Additionally, the bank had introduced a suite of other digital wealth services before this, such as EZInvest on mobile and the Unit Trust Browser (UTB) for unit trust investors, specifically.

Comments (0)