Alex Cheong Pui Yin

5th July 2023 - 2 min read

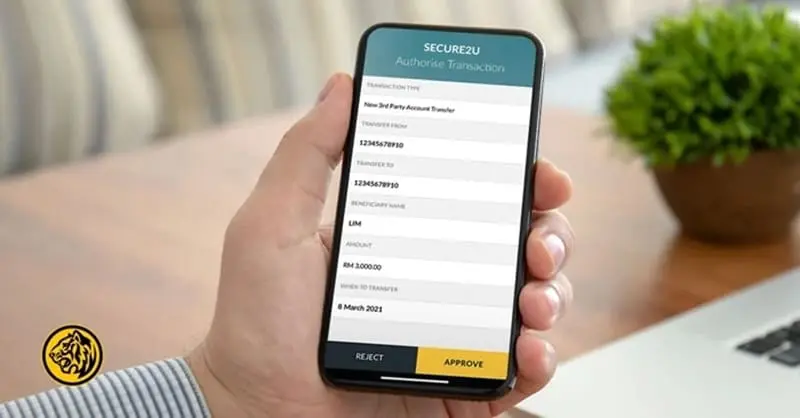

Maybank has announced that starting from 10 July 2023, all online transfers to favourite accounts – including subsequent transfers – will need to be authorised via Secure2u. This expands from Maybank’s previous requirement, where only first-time transfers to favourite accounts needed Secure2u authorisation.

This latest update will impact all customers who conduct any subsequent transfers to favourite accounts come 10 July. These include third-party transfers, GIRO transfers, as well as DuitNow transfers via account numbers, mobile numbers, and ID.

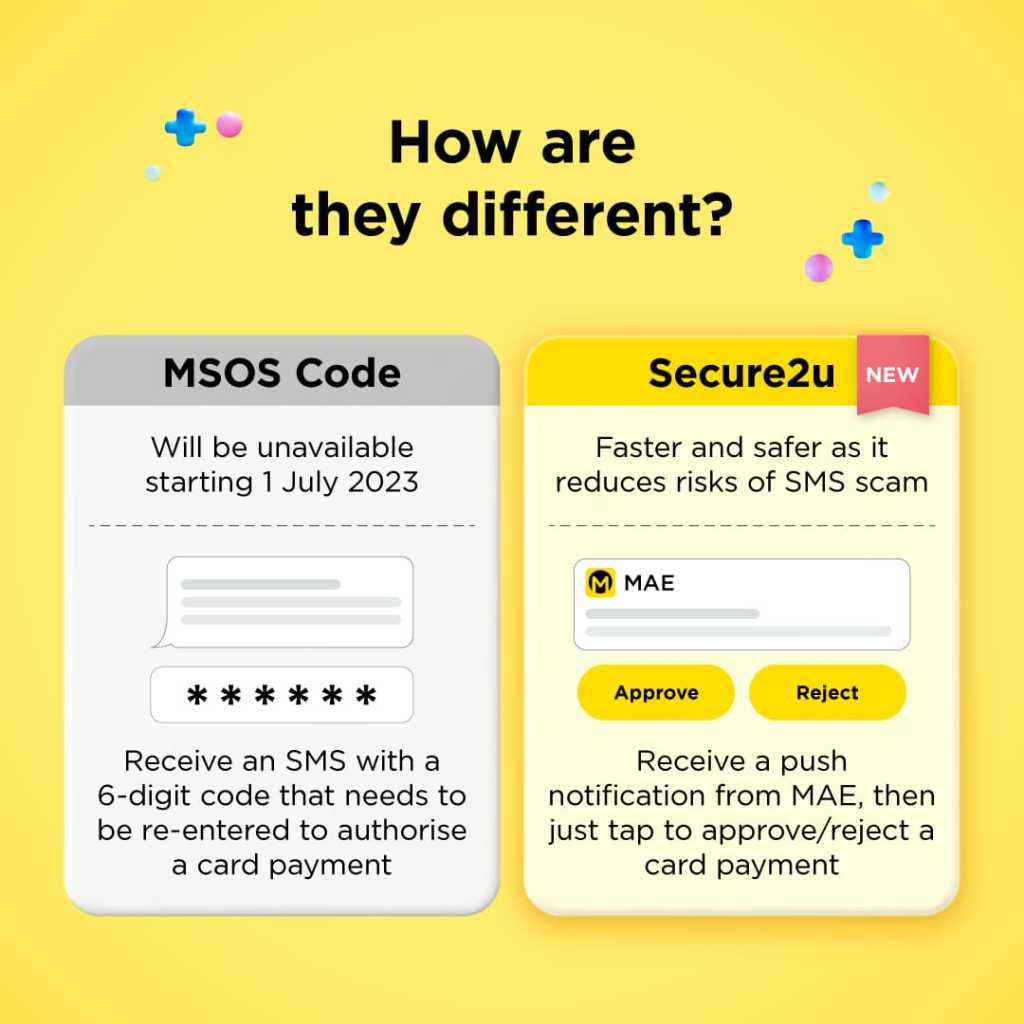

The new verification requirement also came following Maybank’s recent announcement that it has completed its transition from SMS one-time passwords (OTP) to Secure2u. This means that aside from transfers to favourite accounts, other online transactions and banking activities carried out on the Maybank2u web, the Maybank2u app, and the MAE by Maybank2u (MAE) app must also be verified via Secure2u – and not SMS OTPs. Similarly, online debit and credit card transactions, too, will go through the same authorisation process.

Maybank customers should also take note that Secure2u is now only accessible via the MAE app – unlike before, where those who had previously activated the security feature on the Maybank2u app can still continue to use it on the older app. If you need guidance on how to (re)activate Secure2u on your MAE app, here are the few steps that you should take to do it – although it’s a pretty straightforward process!

- Launch your MAE app and tap on ‘Secure2u’ under Quick Actions

- Tap on ‘Activate Now’, confirm your mobile number, and key in your OTP received via SMS

- Enter your IC number, and confirm your device name

You should also be aware that there is a minimum 12-hour cooling period when you are activating Secure2u on your MAE app for the first time, or on a new device. As such, it would be a good idea to perform the activation earlier instead of waiting until you need to carry out an urgent transaction.

(Source: Maybank)

Comments (0)