Alex Cheong Pui Yin

26th May 2023 - 3 min read

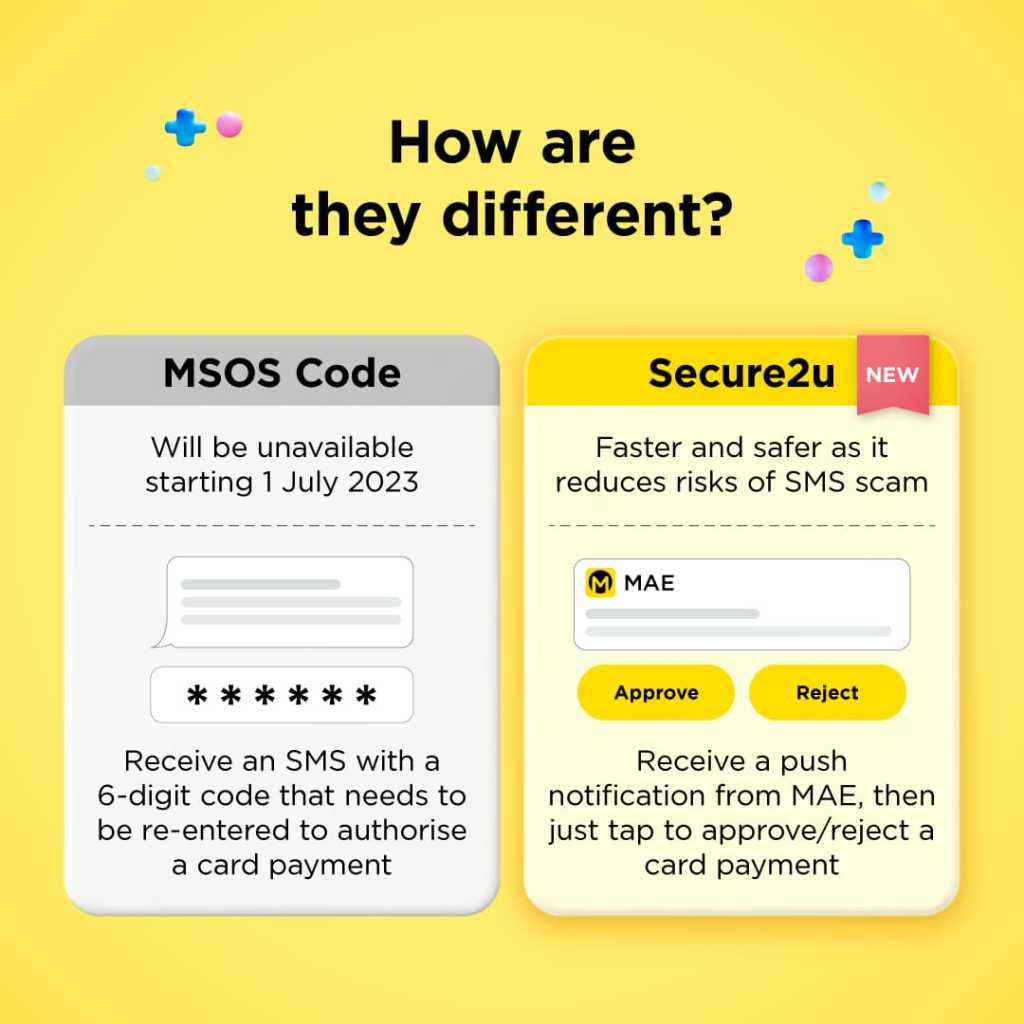

Maybank has announced that starting from 1 July 2023, customers will be required to use Secure2u to approve all their transactions – whether made through the Maybank2u website or app, or the MAE by Maybank2u (MAE) app. This comes as the bank continues to forge ahead to complete its migration from SMS one-time passwords (OTPs) to its preferred transaction authentication method.

Additionally, Maybank said that it is fully moving its Secure2u feature to the MAE app on 1 July, so that there will only be one single point of authorisation moving forward. This is as compared to the current situation where customers who recently activated Secure2u are accessing the feature from the newer MAE app (as Secure2u activations have been moved to the MAE app in September 2022), while those who activated the feature much earlier on the Maybank2u app are still using it from the older platform.

With this, Maybank customers who are still using Secure2u on the Maybank2u mobile banking app will need to download the MAE app and activate Secure2u on the new app, or else they will not be able to authorise any of their online transactions. If you need guidance on how to do so, here’s a detailed video guide from Maybank to help you out:

In a statement, Maybank commented that this consolidation of its Secure2u feature is necessary to offer enhanced online banking security as it will minimise the possibility of a customer’s online banking details being compromised. Customers are also urged to constantly update their MAE app to ensure that they can always benefit from the latest security improvements introduced by the bank.

For those who are unfamiliar with Maybank’s Secure2u, the feature has actually been around for a while as it was introduced all the way back in 2017. While Maybank has been taking steps to encourage customers’ adoption of the feature all this time, major strides were really only made recently following Bank Negara Malaysia’s (BNM) directive for banks to beef up their online banking security. It is essentially described as a “safer and more convenient way to authorise transactions”, where you’ll receive a push notification from your mobile banking app to approve or reject a payment.

Aside from Secure2u, other security measures that have also been rolled out by Maybank thus far include the introduction of the one-account-one-device limitation – where customers are only allowed to tie their MAE account to only one device – and the implementation of a 12-hour cooling period for any new Secure2u activations. On top of that, Maybank also launched a Kill Switch feature that allows customers to temporarily deactivate their Maybank2u access and block their credit card usage if they feel that their online banking details have been compromised.

(Sources: Maybank [1, 2], The Star)

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (0)