Alex Cheong Pui Yin

21st October 2021 - 4 min read

Alliance Bank has finally unveiled its latest card offering after sharing a teaser earlier last week, officially launching the Alliance Bank Visa Signature credit card today. The new card offers tiered cashback of up to 5% on all retail expenses, including online shopping, groceries, dining, petrol, and even utilities.

That said, the reward structure for this Alliance Bank Visa Signature card differs from other cashback credit cards, which usually provides tiered cashback rates that apply to the entire amount spent in a statement cycle. The new Alliance Bank Visa Signature card, meanwhile, allocates tiered cashback at different percentages that apply only to the amount spent in a specified range – which will then be totaled to obtain your cumulative cashback. This makes it similar in spirit with the discontinued Alliance Bank You:nique Rebates credit card, which also utilises a similar reward structure.

Under the new Alliance Bank Visa Signature card, the cashback tiers are provided as follows:

| Cashback tier | Range (RM) | Rates | Cashback amount |

| 1 | RM1 – RM1,000 | 0.05% | Up to RM0.50 |

| 2 | RM1,001 – RM2,000 | 0.5% | Up to RM5.00 |

| 3 | RM2,001 – RM3,000 | 5.0% | Up to RM50 |

| 4 | More than RM3,000 | 0.25% | Unlimited |

As you can see from the table, the 5% cashback rate is applicable only in Tier 3, when your expenses hit the range of between RM2,001 to RM3,000, after which the rate will drop back to 0.25%. For example, if you’ve spent RM3,000 in one statement month, then you will receive a total cashback reward of RM 55.50 (RM0.50 + RM5.00 + RM50).

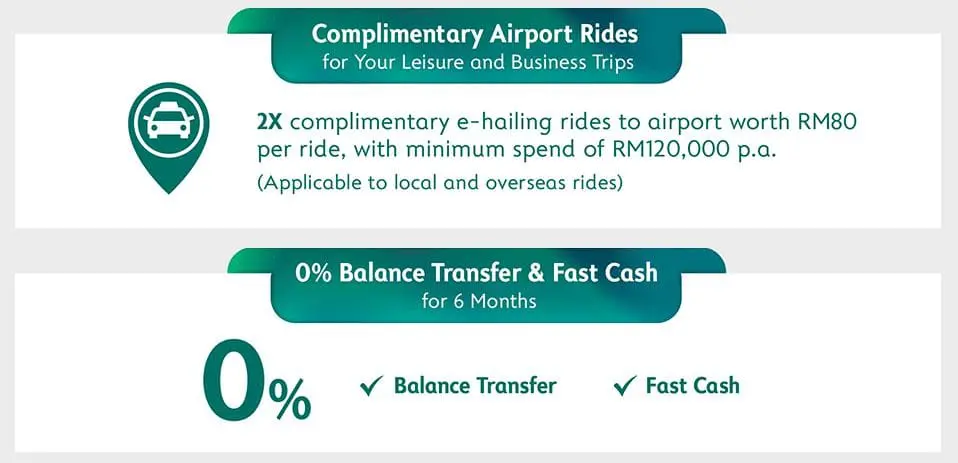

Aside from the cashback benefit, the Alliance Bank Visa Signature card also carries other features, including 2x complimentary e-hailing rides to the airport (worth RM80 per ride), applicable for both local and overseas rides. You are required to spend a minimum annual amount of RM120,000 on your card in order to tap into this benefit. Additionally, the card provides a 6-month 0% balance transfer and fast cash plan that you can sign up for if you need it.

Interestingly, the Alliance Bank Visa Signature also has an exclusive version that is offered only to Alliance Privilege and Alliance Personal customers only, dubbed the Alliance Privilege Visa Signature credit card. What’s unique is that Alliance Bank is positioning this card as a “personal and business” expenses card, which isn’t common because most banks (including Alliance) offer business-only credit cards.

Under the Alliance Privilege Visa Signature card, customers will get to enjoy an additional 3% cashback on top of the 5% cashback allocated for the regular Alliance Bank Visa Signature card. To unlock this additional 3% cashback, cardholders will need to spend a minimum of RM120,000 per year and have a minimum of RM300,000 assets under management (AUM). Its additional cashback rates are tiered as shown below:

| Tier | Asset under management (AUM) | Additional cashback rates |

| 1 | More than RM300,000 | 0.5% |

| 2 | More than RM500,000 | 1.0% |

| 3 | More than RM1 million | 2.0% |

| 4 | More than RM3 million | 3.0% |

Note that for this card, the additional cashback rates are given on top of the Visa Signature’s cashback amount, and is unlimited – which means if you have more than RM3 million in AUM with Alliance Bank, this card will reward you with at least 3% on all your personal and business spending.

Moreover, the Alliance Privilege Visa Signature card offers a 0% flexi payment plan of 12 months for personal and business expenses, including private school fees, medical bills, and even online advertisement and media fees.

The annual fee for both the Alliance Bank Visa Signature card and Alliance Privilege Visa Signature card is set at RM148, applicable only for the principal cardholders, and is waived for the first year. The fees for subsequent years can also be waived with a minimum spend of RM12,000 per annum. Meanwhile, the minimum annual income requirement to apply for these cards stands at RM48,000 per annum (RM4,000 monthly salary), positioning this card between the Visa Platinum and Visa Infinite cards that it relaunched almost exactly one year ago.

Comments (1)

Good cash back card. Return of the features