Alex Cheong Pui Yin

20th August 2021 - 3 min read

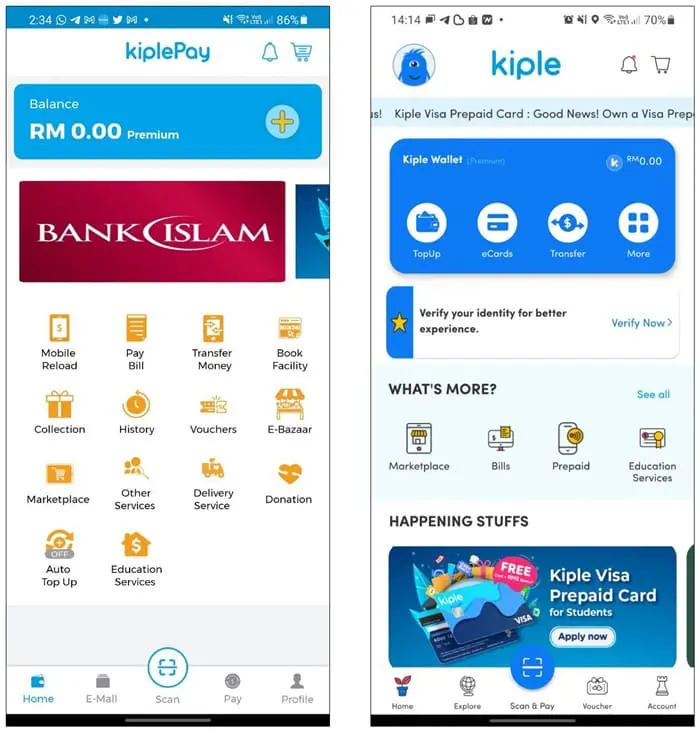

Kiple has officially rolled out its upgraded KiplePay e-wallet, which includes almost a complete revamp of its app as well as two big changes: a new Platinum tier as well as a new Kiple Visa Prepaid Card. Its new app UI, which can be seen in the before-and-after pics above, now looks and performs much like other e-wallet apps available.

The upgraded Platinum wallet tier also puts KiplePay on par (or even above) other e-wallet apps in Malaysia. With a huge RM10,000 wallet size and monthly transaction limit, the Platinum tier expands the usefulness of the KiplePay wallet.

More excitingly, the new Platinum tier also comes with the option to apply for a Kiple Visa Prepaid Card – courtesy of a partnership that was signed earlier by KiplePay and Visa.

According to Kiple in its FAQ section, the Kiple Visa Prepaid Card is tied to the user’s Kiple e-wallet account, and can be used to make cashless payments at over 70 million offline and online retailers where Visa is accepted (which makes sense alongside the expanded wallet limits). You can also use it for expenses such Perbadanan Tabung Pendidikan Tinggi Nasional (PTPTN) and Skim Simpanan Pendidikan Nasional (SSPN) payments, as well as to make cash withdrawals at any Visa ATM machines.

Additionally, the Kiple Visa Prepaid Card is also available both as a physical and virtual Visa card, which makes for an even more seamless payment experience while making online and offline purchases.

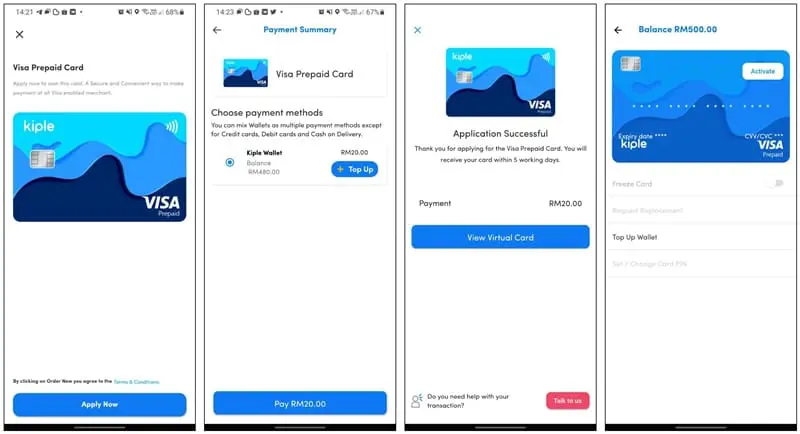

To get the Kiple Visa Prepaid Card, users will need to apply for it via their Kiple e-wallet after upgrading the e-wallet to the Platinum tier. Applications are open to all Malaysian citizens and foreigners aged 18 and above who are currently residing in Malaysia, and can only be done via the newly-updated KiplePay app. The card comes with a card fee of RM20, and an annual fee of RM12 – although there is currently an ongoing campaign that waives the RM20 card fee and gives you a bonus RM5 credit for the first 3,000 applicants.

On top of the introduction of these major features, this latest update will also see the Kiple e-wallet providing personalised rewards to its users in the form of e-vouchers soon. In fact, there are even extra perks for university students who upgrade their Kiple e-wallet and link their e-wallets with their student ID through the KipleCommunity feature.

If you’d like to upgrade your Kiple e-wallet to the latest Platinum tier and apply for the Kiple Visa Prepaid Card, make sure to first update your app to the latest version. You’ll then be required to go through a round of eKYC process to upgrade to the Platinum tier. Once that’s done, you will be prompted to submit an application for the Visa Prepaid Card. Upon approval, you can then expect your prepaid card to be delivered to your doorstep, while you activate the virtual version in the Kiple app.

(Source: Kiple)

Comments (0)