Alex Cheong Pui Yin

24th March 2021 - 3 min read

UPDATE (26/3): Now that we’ve received the update ourselves, we’ve done a deep-dive into the new GO+ feature.

Since the start of the week, the Touch ‘n Go (TNG) eWallet app has been hinting at the upcoming launch of a new investment feature by the name of GO+ with a countdown timer. Described simply as a feature that lets your eWallet balance make money, it is set to be officially unveiled on 29 March 2021 (next Monday!). However, some users appear to have the feature already enabled on their app.

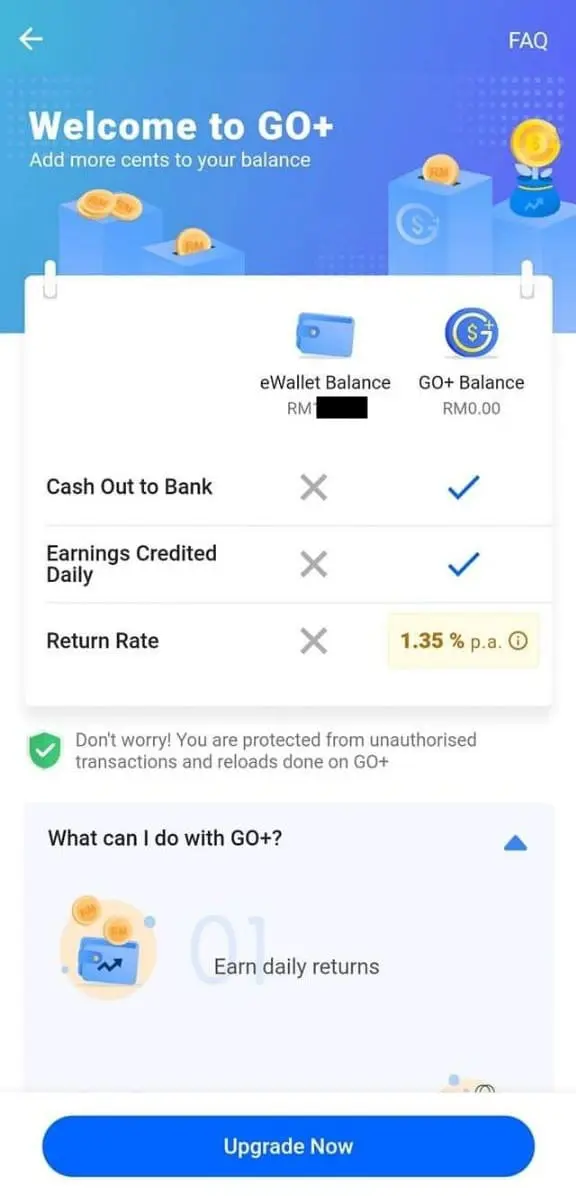

Screenshots of the new feature have also appeared online, and all users will also be able to find a comprehensive FAQ on GO+ on their apps right now.

The screenshot above is among several circulating online, revealing the key benefit of GO+: the ability to use your TNG eWallet credit to invest and earn returns via a low-risk money market fund. Based on the screenshot, the indicative return rate is at 1.35% p.a. – though this will fluctuate based on market conditions. At the current rate, it is slightly lower than the 1-month FD board rates, but returns are also calculated on a daily basis and credited into the user’s account the next day.

The FAQ reveals that the underlying fund for GO+ is Principal e-Cash, a money market fund managed by Principal Asset Management Berhad that aims to “provide investors with liquidity and income”. The feature is only available to verified TNG eWallet accounts who are Malaysians aged 18 years and above.

TNG Digital appears to have managed the liquidity aspect very well, where the minimum investment amount required is just RM10. On top of that, you can also cash out of the investment anytime to either your TNG eWallet or a registered bank account. Another cool feature is being able to tap into your GO+ balance to make payments if your TNG eWallet balance is insufficient.

More information about the new feature is expected to be announced on the 29th of March, where the company will be holding a launch event. In the media invite, GO+ was described as a feature that makes it “more convenient for Malaysians to earn more and spend their investment returns seamlessly”.

The launch of GO+ was widely expected after gaining a conditional approval from the Securities Commission (SC) to operate as a recognised market operator (RMO). This enables the e-wallet to directly distribute capital market products to the public without having to go through third-party applications. Aside from that, TNG Digital – which operates TNG eWallet – had also earlier announced its partnership with Principal Asset Management to launch the Principal e-Cash Fund, Malaysia’s first e-wallet investment solution.

We will be covering more on TNG eWallet’s GO+ feature when it is officially launched in a few days, so stay tuned!

Comments (6)

Bank interest rate is 1.5% to 2%, TNG+ only 1.45%, TNG+ take you money and put in bank for 2%,then return you 1.45%, who is making profit ?

Well bank’s interest is 2% ANNUALLY, compared to 1.45% DAILY, well…..

Not daily, it is 1.45 annually but spilt it up and return in daily, so basically your 1.45% interest will be spilted into 365 parts and return to you daily.

“Investment” is the rubric. But how practical it will be as “investment” if (as most people) will be using go+ as just another current /liquid account with funds <RM100K is anybody guess. OK serious investor with at least more than RM100K, can compare with other funds e.g. trusts, stock portfolios etc. The part about easy transfer between TnG wallet & your bank account is trivial.

Is there any fee to pay for management or withdrawer etc?

As a TNGO e Wallet user, the most important things went it comes to investment portfolio is that , the whole investment portfolio MUST Syariah Compliance..It is compulsory..if not..just forget it