Alex Cheong Pui Yin

6th July 2023 - 3 min read

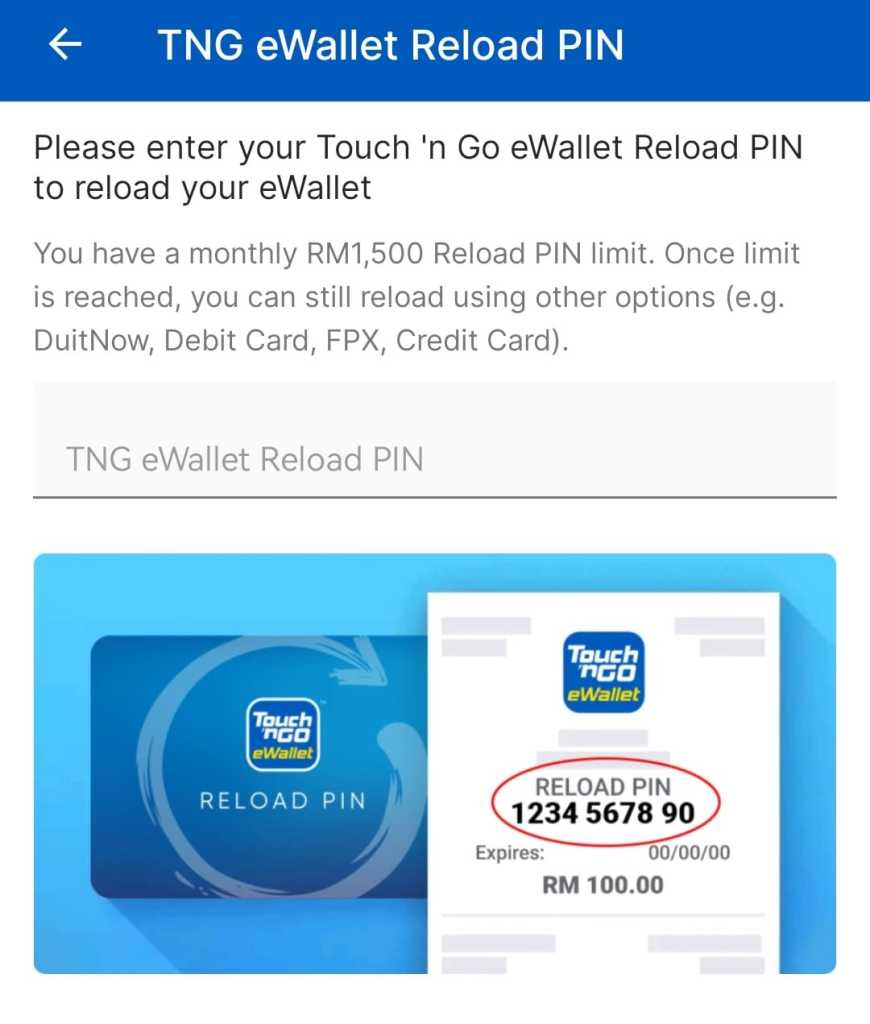

Touch ‘n Go (TNG) eWallet is set to revise the monthly limit for the amount that you can top up via TNG reload PINs, increasing it from the existing RM1,500 to RM8,000. This revision – which will take effect on 27 July onwards – was revealed in the e-wallet’s latest T&C document, where it also said that funds from TNG reload PINs will soon be classified as non-transferable funds.

For those who are unaware, your TNG eWallet balance is actually split into two categories: transferable and non-transferable balance. This depends on the source of your top-up funds. At present, transferable balance refers to any eWallet reloads that do not come from credit cards – like debit cards, online banking, and TNG reload PINs. Funds from these top-up sources can be transferred to other TNG eWallet accounts, bank accounts, or GO+ (hence the name transferable balance).

Meanwhile, non-transferable balance is defined as any top-up amount that comes from credit cards, and they cannot be transferred to other accounts. There is a slight leeway given, however; TNG eWallet permits a monthly quota of credit card reloads to be treated as transferable eWallet balance for free – which is set at RM1,000 (for users of all TNG eWallet tiers). If you’d like for subsequent credit card top-ups (exceeding the allocated RM1,000 quota) to also be treated as transferable balance, then you’ll have to pay an admin fee of 1%.

Come 27 July, however, all funds from TNG reload PINs will fall under the category of non-transferable balance, and you will no longer be able to transfer them to other TNG eWallet accounts, bank accounts, or GO+. Instead, you can only use them for online and offline retail transactions via the eWallet, including bill payments, prepaid reloads, parking, movie tickets, and purchases from partner platforms.

Additionally, TNG eWallet stressed that this amount will not qualify for the RM1,000 monthly quota of non-transferable balance that can be treated as transferable balance – that quota will be maintained purely for credit card top-ups. The T&C document does not state, however, whether you can re-classify the reload PINs to be transferable by paying the 1% admin fee mentioned above.

Aside from these revisions, no other amendments were made to other limits, including its wallet size, monthly transaction limits, as well as annual transaction limits:

While TNG eWallet did not share an explanation for this latest revision, it is likely introduced as a way to streamline the e-wallet’s features, ensuring that users use it in a responsible manner. It is also worth noting that the existing RM1,500 was itself reduced from a previous monthly limit of RM5,000.

(Source: TNG eWallet)

Comments (17)

Newly apply for TNG ewallet and maximum reload was RM200.

After the reload, I can only do payment to merchants only.

Unable to transfer or pay for my food.

why e wallet account can’t transfer to other bank???

tolong tukar sisitem ni… susah nak transfer duit

I like the information, good thing, now I can’t even pay in a mamak restaurant, just because of that non-transferable thing. Then what can I do for it, how can I get my top-ups back as cash? I visited the tng website but it’s useless, tng service counter… rarely give me an answer.

It’s no longer an ewallet if I cannot make the payments I need to from it. I have been caught in a bind at a restaurant I ate at, but just as well I had enough cash to cover the bill when this so called ewallet decided that I cannot make payment to a restaurant because of the non transferable amount I had. Useless!

However, this is also one of the control to mechart they need to register a mechart account to let you pay by the mechart QR code but not personal QR code. Which by this, business is not able to skip for INCOME TAX.

this killing tng.. will never use tng again..

This is seriously bull****, as someone who can’t access easily to my own bank, (for cdm) i usually use tng topup pin since it more convenient to transfer money and more accessible, now with this new update, guess i have to make 1h+ trip again just to put money in my bank

Use FPX to transfer from your bank to your TnG, it will be transferable fund

So now if i reload ewallet tng pin from convenience store it’ll be non transferable? how can i change my non transferable ewallet to transferable ewallet? because i have money balanced in the non transferable category but i cannot transfer to other tng accs

bye bye tng bad deciaion

It’s necessary, else everyone will be able to get cash advance from their credit card (via TnG pin) without any cost

Stupid decision

I tried paying at a restaurant from their qr and it didn’t work for non transferable money. How can I get transferable money as a foreigner or do I now need to pay in cash every where?

After 27 July, there’s no transfer from my Tng to other Tng account untill i paid for fee is’t it?

What so you mean paid for fee?

What fee?