Pang Tun Yau

31st July 2020 - 6 min read

Today, eligible Malaysians can officially redeem the RM50 free e-wallet credit under the ePenjana short-term economic recovery plan. You can do so from the three official e-wallet partners: Boost, Grab, and Touch ‘n Go eWallet. Under the ePenjana plan, the e-wallet partners will also match the RM50 credit with equivalent perks – but which e-wallet is offering the best ones?

All three e-wallet companies are offering a wide range of vouchers ranging from F&B, retail, and lifestyle categories. One thing you’ll notice when comparing the vouchers is that they all have a minimum spend requirement – it’s not appealing as a user (RM5 off minimum spend of RM25, RM10 off RM100, etc), but let’s not forget that this is a stimulus package to spur the economy.

In essence, the government is incentivising Malaysians to spend on local businesses affected by Covid-19 and get the wheels of the economy moving once again.

Finally, the ePenjana credit can be used for any transactions, both online and offline. This includes in-app services such as bill payments, and wallet-specific features, such as Grab services (Grab rides, Food, Mart, etc) and Touch ‘n Go RFID toll payments. The only restrictions are transferring it to another person’s wallet, or cashed out (which you can’t anyway since all three e-wallets don’t offer that function).

Boost – Additional RM80 in vouchers

Under its #KasiTambah campaign, you can get an additional RM80 in benefits if you claim your ePenjana credit from Boost. RM60 of this actually comes from monthly RM5 discounts off a Celcom XP Lite postpaid plan for a year, with the remaining RM20 in the form of random cashback vouchers in a Lifestyle Rewards Bundle once you spend RM5 of the ePenjana credit.

On top of that, all approved applications will also count as one entry to stand a chance to win monthly prizes, such as a Perodua Myvi, a Yamaha motorbike, as well as gadgets and gift vouchers.

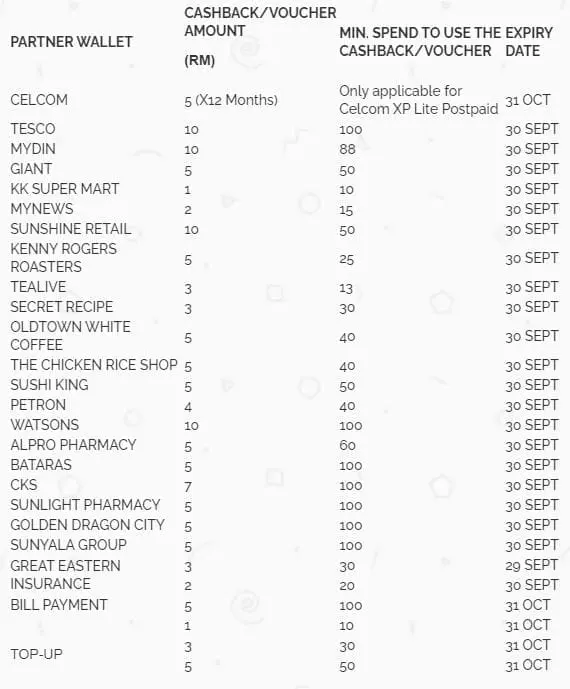

Note that the vouchers in the Lifestyle Rewards Bundle are “cashback” vouchers, which will be given into the Partner Wallet and can only be claimed from the same merchant in your next transaction. For example, spending a minimum of RM100 in Tesco will earn RM10 in your Tesco Partner Wallet, which can be used to offset your next purchase at Tesco.

Here’s the full list of vouchers that can be included in the Lifestyle Rewards Bundle.

Grab – Up to RM125 in vouchers

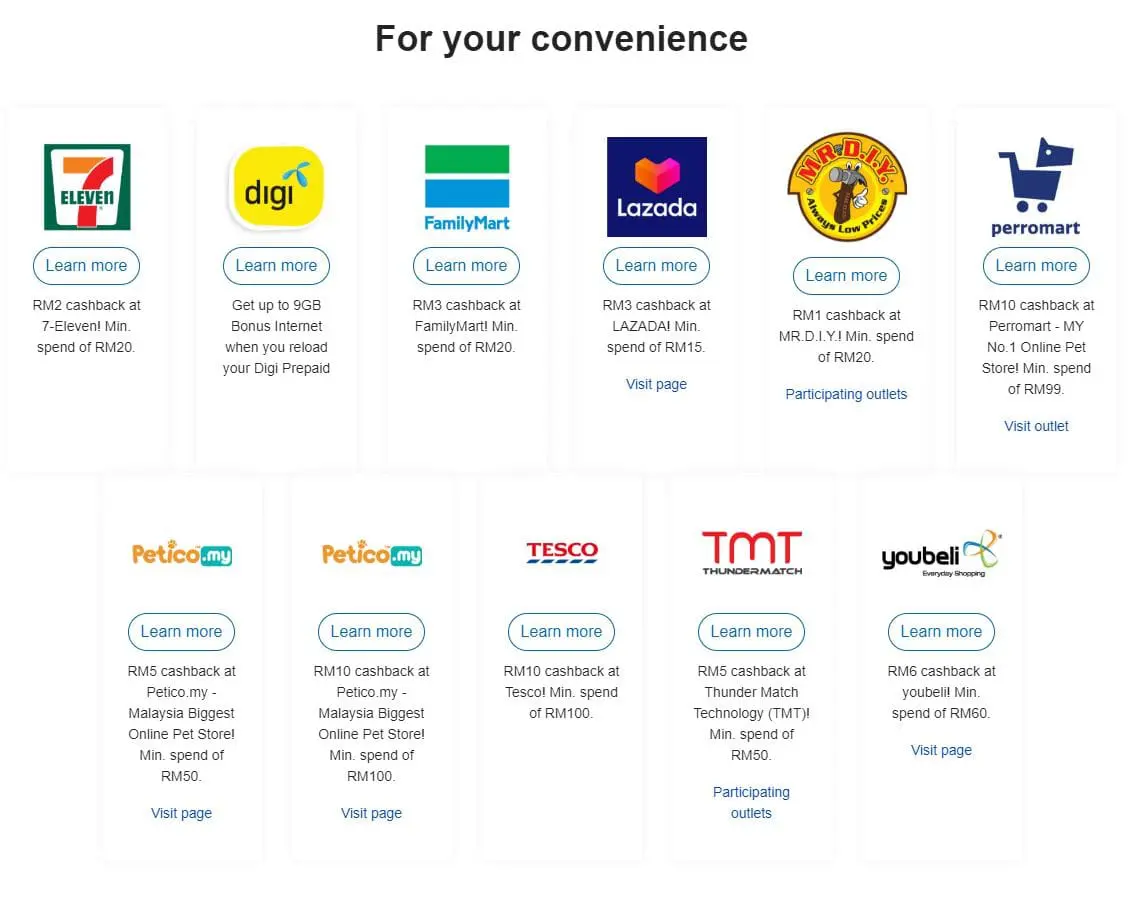

Grab is matching the RM50 ePenjana credit with RM50 worth of vouchers. Unlike both Boost and TNG eWallet (as you’ll see below), the vouchers are fixed and are not given randomly. You will get RM5 vouchers for six F&B outlets, and two RM10 “lifestyle” vouchers. Note that each voucher has its own terms and conditions for usage, and may have differing minimum spend requirements, which you can read here.

In addition, Grab is giving another set of vouchers worth a total of RM75 as part of a Weekly Bonus. To be eligible, you’ll need to be among the first 7,000 to spend the RM50 ePenjana credit and use at least one Grab service (Grab ride, GrabFood, GrabMart, or GrabExpress) within the campaign week to win the bonus of RM75 in vouchers on top of the RM50 voucher bundle, for a total of RM125 in bonuses.

Note also that you will also earn GrabRewards points when you spend using the ePenjana credit, as well as any portion of payment that isn’t covered by the ePenjana vouchers. Depending on your GrabRewards tier, you can earn up to 3 GrabRewards points for every RM1 spent – you can read more about the value of GrabRewards points in our analysis.

Touch ‘n Go eWallet – Over RM300 in vouchers

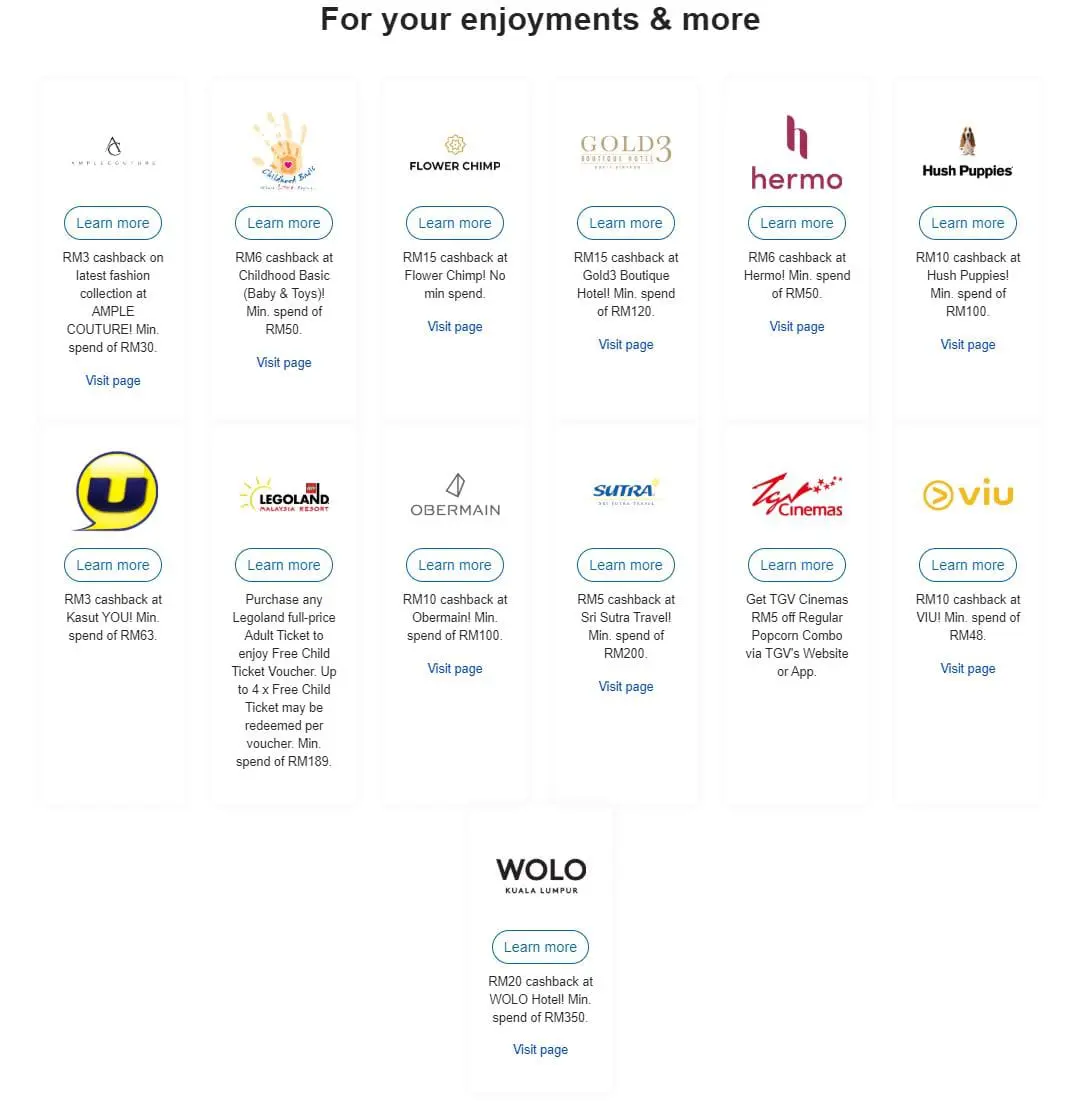

As for TNG eWallet, you’ll need to be among the first 1 million claimants to reap the full benefits of the additional perks. That’s because you’ll get fifty vouchers worth more than RM300 in value – here’s the full list:

However, after the first 1 million successful claims, the remaining 4 million allocations (TNG Digital says it is capping the total claims to 5 million only) will receive a random set of vouchers and on a first come, first served basis until all voucher allocations are exhausted. There’s no mention of the total value of this bundle you’ll receive, so it’s probably best to act fast if you want to claim from TNG eWallet.

Like Boost, most of the vouchers you’ll receive are “cashback” vouchers. Unlike Boost, which gives cashback in Partner Wallets (i.e. cashback earned can only be used at the same merchant), TNG’s cashback vouchers will be credited into your “main” wallet, which can then be used anywhere else. The only exceptions to these are the vouchers from Legoland, Starbucks, Tealive, and TGV Cinemas, which will deduct the discount value immediately at the point of purchase.

Which E-Wallet Offers The Best ePenjana Bonuses?

With all three e-wallet companies offering a host of vouchers with huge total values, it is important to take a closer look and go beyond face value.

For example, 75% of Boost’s bonus value (RM60) comes in the form of rebates when you apply for a new Celcom postpaid plan – this won’t be useful to many people. Plus, the remaining RM20 vouchers offer cashback into your account’s Partner Wallet, which will only offset your next transaction at that merchant – it’s fine if you’re a regular customer, but not so if you’re looking to enjoy immediate one-off benefits.

On the other hand, TNG eWallet claims the total value of the vouchers you can get is “over RM300”, but there are two observations to be made:

- most vouchers offer cashback values of around RM2-3

- the total value of the vouchers is actually over RM1,000, taking into account the 4x free Child Ticket Vouchers to Legoland

As for Grab, the RM50 additional vouchers appear modest in comparison, but are heavy in popular F&B chains – that means there’s a higher chance you’ll use them. The additional RM75 Weekly Bonus, while welcome, requires you to quickly spend your RM50 credit and that may lead to impulsive spending.

So, all things considered, which e-wallet offers the best perks? With relatively low discount values coupled with minimum spending requirements, it’s hard to pick the “best” of the lot. Unlike the previous RM30 e-Tunai Rakyat digital incentive, there are more restrictions under the ePenjana bonuses. Therefore, it is perhaps better to view these vouchers as “value added bonuses” that you don’t need to take full advantage of – whichever set of vouchers cover your regularly-visited retail or F&B spots would be a good choice.

After all, the best part about the ePenjana credit is that you can now use it for essential things like bill payments, transportation (Grab rides), and toll payments.

Comments (0)