Alex Cheong Pui Yin

22nd August 2022 - 3 min read

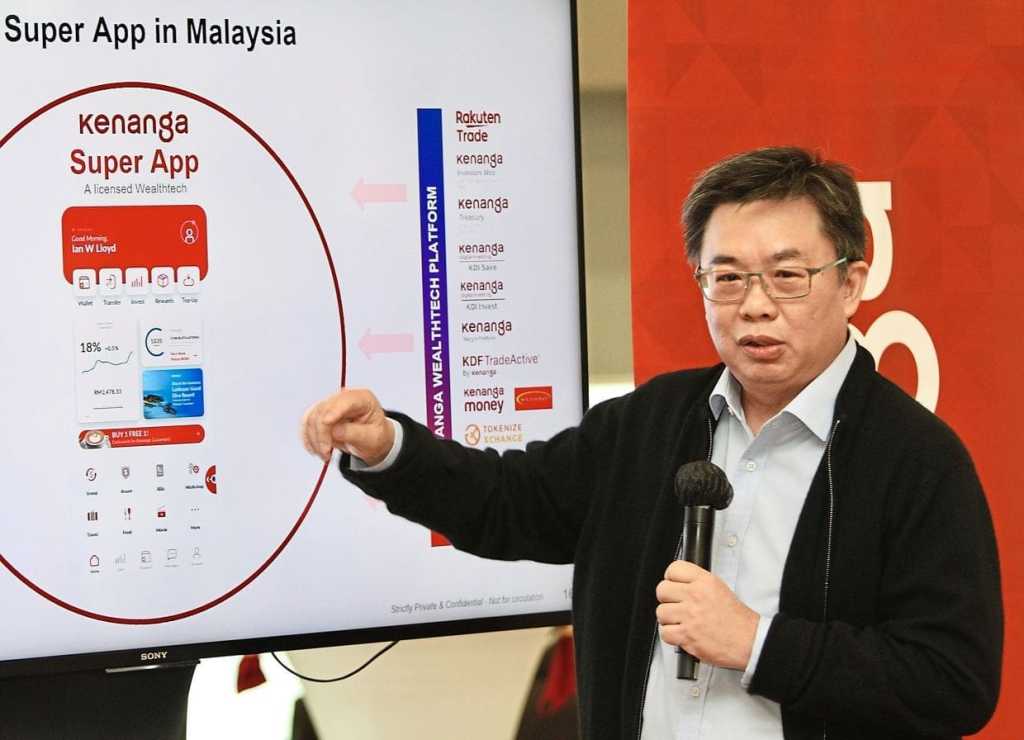

Kenanga Investment Bank Bhd has revealed that it is in the midst of conceptualising and developing a super app, which will provide users with access to a range of financial service products and options in trading. These include currencies, broking, investment, digital assets, as well as small and medium enterprises (SME) financing.

Slated for launch in the first quarter of 2023, the group managing director of Kenanga, Datuk Chay Wai Leong said that the super app seeks to present wealth management as a digital solution. It will cater to the needs of both Kenanga’s current base of high income and net-worth individuals, as well as a new base of mass-market customers and investors.

As such, the super app will offer simplified investments and small ticket size with short-term liquidity, and at the same time, be cost-sensitive as well. The new base of customers will also be able tap into a self-service advisory, catering to investors with different levels of risk tolerance.

On top of that, the super app will also utilise algorithm and quant trading platforms to generate trading opportunities for its investors. Briefly, quant trading refers to trading that uses mathematical and quantitative strategies or analysis to evaluate financial products or markets.

Datuk Chay explained that Kenanga’s motivation to develop the super app is rooted in its desire to capture the market share in the digital trading business. “We believe digital is the future. We believe in the concept of cross-selling and cross-marketing, and eventually hope to be a big player in the digital fintech space,” he said, adding that the super app may cost a low double-digit million ringgit to build, but it will be worth the investment.

“This will be a revenue stream. You can treat it like a distribution channel. When you sell shares, for example, you pay remisiers a share of the revenue. For unit trust, you pay the agent, those will be where we will come in. The super app will get the cut of the distribution fee,” Datuk Chay further said.

Meanwhile, the chief digital officer of Kenanga, Ian Lloyd highlighted that the super app will be designed to be secure, easy to use, and accessible. “It is not rocket science to bring this together. The critical challenge is how do we make it simpler and easier for people to use. Internally, we want to have everything rock solid and stable, like cybersecurity is incredibly important to us. We are focusing on simplicity and on making it super easy to get started,” he said.

Kenanga hopes to onboard between 500,000 to 600,000 investors once the new super app is launched in early 2023, although it did not share an exact timeline to achieve the target.

Kenanga’s latest achievement to date is its AI-driven digital investment management platform, Kenanga Digital Investment (KDI), which crossed RM100 million in asset under management (AUM) just two months after its launch in mid-February 2022. KDI has two key features on its platform, namely KDI Save and KDI Invest. Specifically, KDI Save is a cash management fund that allows users to earn daily returns with no lock-in period and management fees, whereas KDI Invest offers access to US-listed exchange-traded funds (ETFs) at a competitive fee.

(Source: The Star)

Comments (0)