Alex Cheong Pui Yin

12th March 2024 - 2 min read

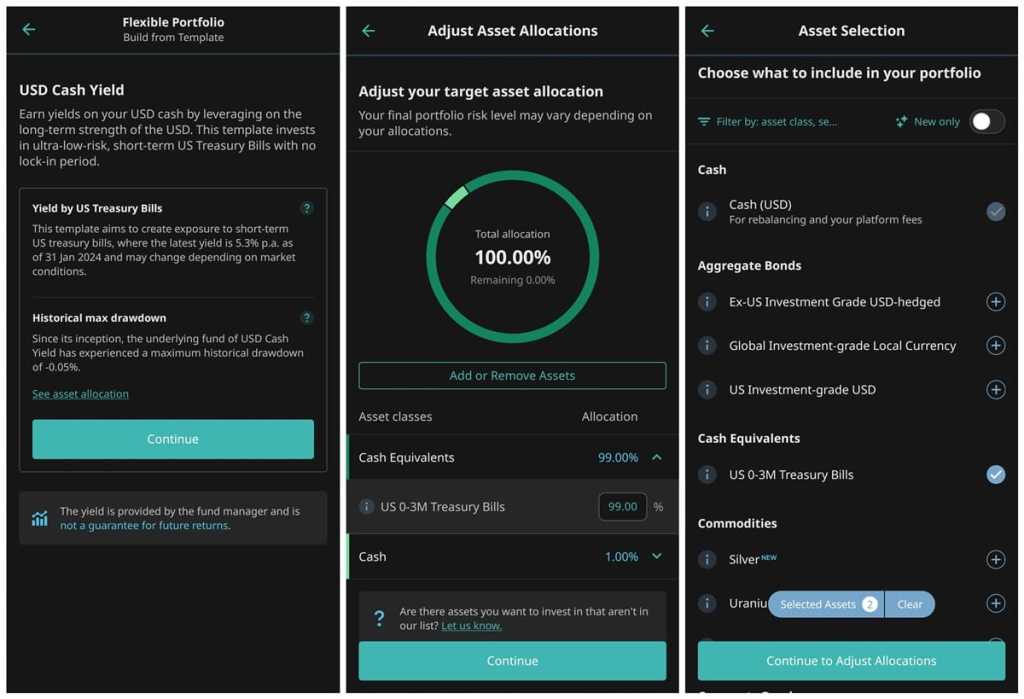

StashAway has introduced a new investment offering under its Flexible Portfolios, called the USD Cash Yield Portfolio. It is expected to help investors earn a yield of 5.3% p.a. on their cash by investing in short-term US Treasury bonds (up to three months’ maturity).

According to StashAway, the USD Cash Yield Portfolio will let you grow your wealth in USD, and is suited for those who are looking to diversify their cash holdings with some exposure to the US dollar. This is especially since the US dollar has appreciated against the local currency in the long term, and is the world’s reserve currency. Additionally, the portfolio can be appealing for those who plan to use it for future travels or investments, or their children’s education abroad in the future.

StashAway also explained that US Treasury bonds carry very limited credit risk since they are backed by the US government, which is very unlikely to default on its debt obligations. Treasury bonds are also liquid, which means that they can be easily sold for cash.

Those who do decide to invest in the USD Cash Yield Portfolio will start with a “template” portfolio, with 99% exposure to short-term US Treasuries. From there, they are free to customise their portfolio by adding or removing from more than 55 asset classes available, since the USD Cash Yield Portfolio is provided as an offering under Flexible Portfolios. You’re also able to adjust the weightage of each asset class according to your preference.

StashAway further reiterated that there are no minimum and maximum investment requirements, as well as withdrawal restrictions for its USD Cash Yield Portfolio – similar to its other investment offerings. In terms of fees, note that there is a management fee of 0.3% p.a. by StashAway itself, and another ETF (exchange-traded fund) manager fee of 0.07% p.a.. Additionally, StashAway’s custodian bank also charges a one-off currency conversion fee of 0.10%.

If you’re interested in finding out more information on StashAway’s USD Cash Yield Portfolio, you can head on over to its official website here. However, do be aware that you can only carry out the investment transaction via the StashAway mobile app as the USD Cash Yield Portfolio is only available on the app.

(Source: StashAway)

Comments (0)