Alex Cheong Pui Yin

28th January 2022 - 3 min read

Robo advisor StashAway has announced that it will once again be re-optimising its clients’ portfolios to offer better protect against an inflationary growth environment that has begun to affect more global economies.

In particular, this round of re-optimisation will see StashAway adjusting its existing inflation hedges, as well as its international equities allocation. With regard to the adjustments of its existing inflation hedges, StashAway noted that it will:

- Reduce allocations to developed and emerging market government bonds in favour of high-quality US corporate bonds and inflation-linked government bonds.

- Reduce allocation to US consumer staples (XLP), US REITs (VNQ), and slightly in US energy (XLE) due to high valuations – and will instead increase allocations for US small-cap (IJR) and financial stocks (XLF).

Meanwhile, in terms of the allocation of international equities, StashAway is pulling away from Australian and Japanese equities, preferring instead to invest more in Canadian equities. It will also maintain its allocation for China tech.

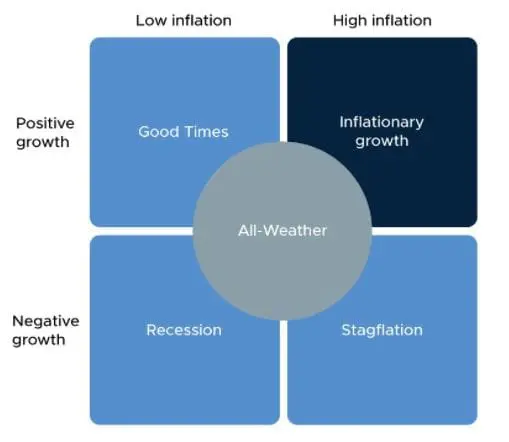

In justifying this round of re-optimisation exercise, StashAway said that the inflationary growth environment – which had previously affected primarily United States and caused StashAway to carry out its last round of re-optimisation back in July 2021 – has now expanded to cover other global markets as well. Briefly, inflationary growth is described as a situation where the economy is growing, but is hampered by an even faster growth of inflation. As such, the quality of growth is eroded, and “real” growth is affected.

“Our macroeconomic indicators show that the rest of the world is now following suit: inflation is outpacing growth not only in the US, but also across global markets. And in the US, inflation continues to deepen, reaching its highest level of inflation in nearly four decades,” the robo advisor explained.

StashAway also foresees inflation to persist throughout 2022. “Policymakers have acknowledged that it’s taking longer to move on from inflation than expected. Global events – such as a new Covid variant continuing to disrupt supply chains, labour shortages, contributing to higher wages, and stimulus measures keeping the economy rolling amid a global pandemic – continue to push up prices worldwide,” it said, adding that central banks around the world will likely hike interest rates in 2022 to rein in inflation. China, however, will be an exception as it has cut its interest rate for the first time in two years to boost economy.

Finally, StashAway said that it will continue to keep an eye on the data. “It’s easy to get caught up in news about the pandemic, inflation, and interest rates, and their effects on the market. But remember, inflation-adjusted growth is the ultimate driver of returns in the medium and long term,” it reminded.

Since its launch in 2017, StashAway has re-optimised its portfolios a total of four times: December 2017, August 2019, May 2020, and July 2021 – with this latest one being its fifth.

(Source: StashAway)

Comments (0)