Alex Cheong Pui Yin

29th March 2022 - 2 min read

The Employees Provident Fund (EPF) has shared that members who wish to apply for the special RM10,000 withdrawal facility will be able to do so through the Pengeluaran Khas portal.

The dedicated portal – which is set go live on 1 April 2022 when applications open – will also be made accessible through the i-Akaun mobile app for the convenience of its members.

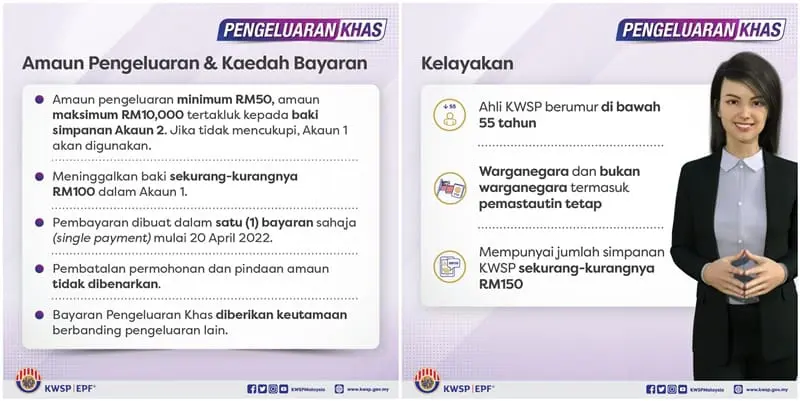

Aside from that, the EPF also revealed that the withdrawals are subject to members’ minimum account balance; you must have at least RM150 in your EPF savings (Akaun 1 and 2 combined) in order to apply for a withdrawal. Funds will be drawn first from your Akaun 2, and if it is insufficient, then you can access your Akaun 1 savings. Like the previous Covid-related withdrawal facilities allowed by the EPF, you are also required to leave at least RM100 in your Akaun 1 balance after the withdrawal.

Note as well that you will not be allowed to cancel your application or amend the withdrawal amount once you have made a submission. Additionally, your funds will be disbursed in a single payment, as opposed to the staggered payment approach adopted for previous withdrawal facilities (for instance, the funds paid out for i-Sinar was staggered over a period of six months). The EPF also clarified that it will prioritise the payment of the special withdrawal over other withdrawals.

Members who apply for the special withdrawal can check their application status starting from 9 April 2022 via the Pengeluaran Khas portal. Before you apply, though, make sure to check on several key details in advance for a smooth application process, including ensuring that your current mobile number is registered with the EPF.

Announced in mid-March 2022, the special RM10,000 withdrawal facility is intended as a form of assistance for individuals who are still struggling with their finances due to the Covid-19 pandemic. It is open to members who are aged below 55 years old (inclusive of citizens, non-citizens, and permanent residents), allowing them to withdraw between a minimum of RM50 to a maximum of RM10,000.

Comments (0)