Samuel Chua

6th December 2024 - 2 min read

SeaMoney has launched SFinancing-i, a Shariah-compliant digital financing solution, in collaboration with Sedania As Salam Capital and Masyref Advisory.

This service, now available on the Shopee app, allows users to access funds of up to RM20,000 within 24 hours of successful activation. Users can choose payment periods ranging from three to 24 months. The service is currently available to selected whitelisted users, with plans to expand access in the future.

The service is structured using a Commodity Murabahah arrangement, under which SeaMoney facilitates the purchase and sale of commodities through an Islamic commodity platform for each financing request. This structure ensures adherence to Shariah principles, providing users with a financing option that aligns with Islamic law.

To activate SFinancing-i, users can navigate to the “Me” section on the Shopee app, select “SLoan/SFinancing-i,” and follow the on-screen instructions. The activation process involves uploading identification documents, providing additional required information, and performing facial verification.

Upon successful activation, users can request financing by specifying the desired amount, selecting the repayment tenure, choosing the disbursement method, and stating the purpose of the financing. The profit rate for SFinancing-i is fixed at 1.5% per month throughout the financing tenure.

Khairul Nisa Ismail, CEO of Sedania As Salam Capital, emphasised the company’s dedication to providing a halal financial services platform that upholds the highest standards of Shariah compliance. She noted that this collaboration enables Shopee users to access financing supported by a fully digital commodity platform through a Commodity Murabahah arrangement.

Khairil Anuar, Principal of Masyref Advisory, highlighted the importance of offering financing solutions that comply with Islamic principles. He stated that Masyref Advisory’s extensive experience in Shariah advisory ensures that SFinancing-i maintains the highest standards of compliance while addressing the unique needs of the market.

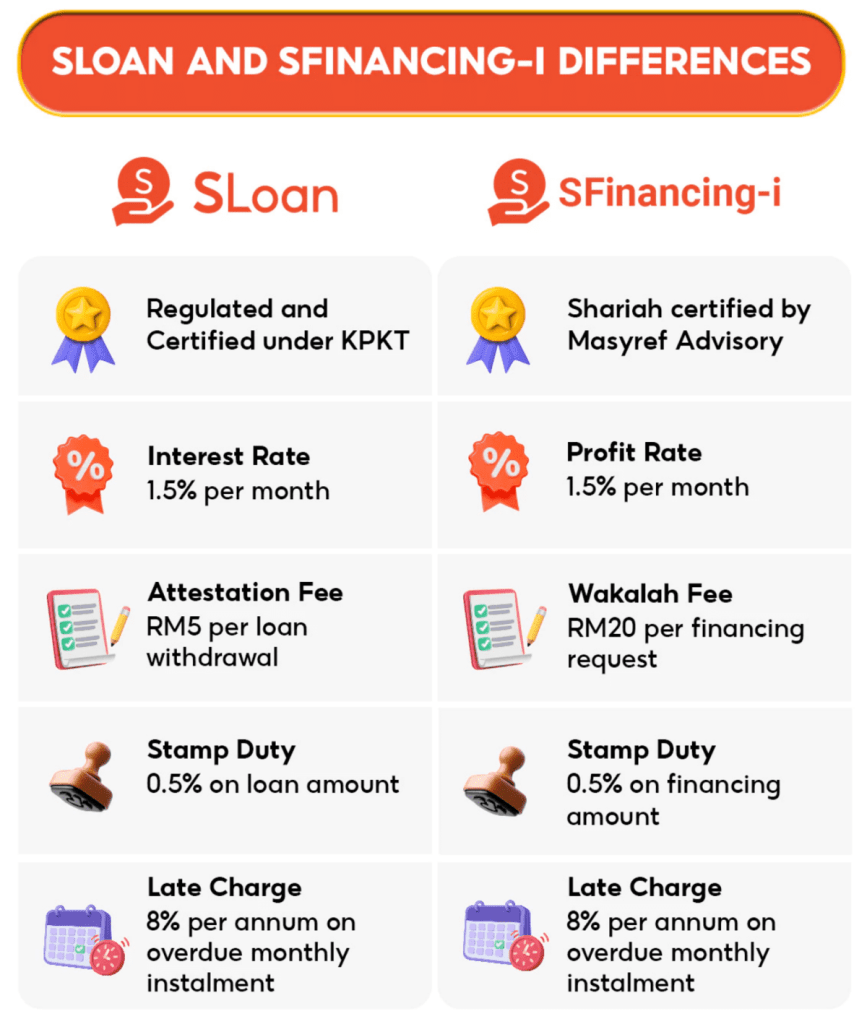

SFinancing-i is the second personal financing facility offered by Shopee. Its first is a personal loan product called SLoan, launched in February 2023.

Comments (1)

Good to have Shariah version!