Jacie Tan

27th July 2022 - 7 min read

(Updated 27 July 2022.)

Back in August 2020, three powerhouses: Maybank, Grab, and Mastercard teamed up to conceive the Maybank Grab Mastercard Platinum, a credit card that uses the GrabRewards points system instead of Maybank’s TreatsPoints. The co-branded card struck a lot of firsts in the market – including same-day online approval, instant issuance of a temporary digital card for Maybank2u users, and being Malaysia’s first dual-faced card.

While there certainly are a lot going for it, this card has a lot to prove given the popularity of Maybank’s credit cards. Let’s delve in a bit deeper and see just how rewarding the core benefits of the Maybank Grab Mastercard Platinum are.

Up to 5x GrabRewards Points And No Cap In Points Earnings

The Maybank Grab Mastercard Platinum’s benefits are simple: you earn GrabRewards points on every ringgit you spend on the card. You earn the highest 5x points multiplier for Grab-related transactions and 2x points for overseas and e-commerce spend. For other local transactions (except for some exclusions like government and non-Grab e-wallet transactions), you earn 1 GrabRewards point for every RM3 spent.

| Expenditure | GrabRewards Points |

| Purchases made in the Grab app (including GrabPay e-wallet reloads) | 5x points for every RM1 spend |

| E-commerce and overseas purchases | 2x points for every RM1 spend |

| Eligible local transactions | 1x points for every RM3 spend |

Unlike the Maybank Shopee Visa Platinum and the CIMB e Credit Card, there is no cap on the amount of GrabRewards points that you can earn in a calendar month with the Maybank Grab Mastercard Platinum.

While we’re on the topic of earning GrabRewards points, it’s important to note the recent update in mid-2022 on the points expiry mechanism that effectively makes GrabRewards points evergreen. Now, you simply have to make a transaction using GrabPay and your entire points balance will expire on the next three-month block. This effectively means your GrabRewards points will not expire, as long as you continue to use Grab regularly.

In comparison, most credit card rewards points have an expiry date. Maybank’s TreatsPoints, for example, have a validity period of 3 years after the transaction. Plus, GrabRewards points not only can be used to redeem vouchers from the catalogue, they can also be used to directly offset purchases.

Earn Up To 5% In Effective Returns

With the introduction of the new GrabUnlimited plan, which now determines the redemption rate of your Grab vouchers, it also changes the effective returns of the Maybank Grab Mastercard Platinum – and surprisingly, it’s potentially better than before the GrabUnlimited revision.

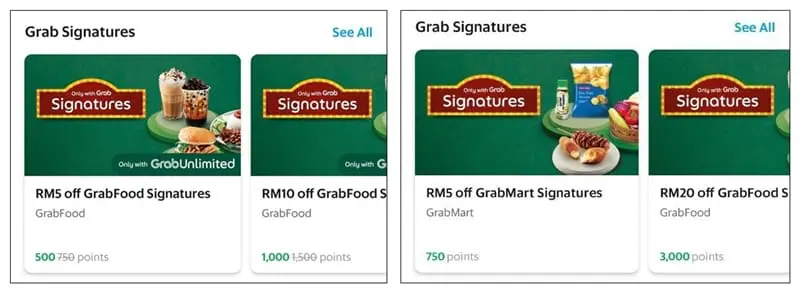

While you can use your GrabRewards points to redeem miscellaneous things like shopping vouchers and prepaid top-ups, for the purposes of this review, we’ll focus on the redemption of Grab vouchers for Grab services in values of between RM5 to RM20 (as they generally have the best redemption value).

For these vouchers, the redemption rate has been updated to 750 points or 500 points for RM5 – depending on whether you’re subscribed to GrabUnlimited or not. Assuming that you are, each GrabRewards point will then actually be worth 1 sen (RM5/500 points). Based on this rate, here’s the respective percentage of cash-equivalent returns for each category of spend using the Maybank Grab Mastercard Platinum:

| Expenditure | GrabRewards Points earned | Rate of Returns |

| Purchases made in Grab app (including GrabPay e-wallet reloads) | 5x | 5% |

| E-commerce and overseas purchases | 2x | 2% |

| Eligible local transactions | 0.3x | 0.3% |

Before the GrabUnlimited revision, the Maybank Grab Mastercard Platinum’s maximum effective rate of return was 3.175% based on the old redemption rate of 800 GrabRewards points for a RM5 voucher. Since the revision improves the redemption rate (for both GrabUnlimited and non-GrabUnlimited subscribers), it also effectively improves the returns of the Maybank Grab Mastercard Platinum.

If you’re not too keen on using your points on Grab vouchers, another way you can use your points is through the Pay With Points feature. The main advantage of the Pay With Points option is that you’re not limited to reaping your rewards through Grab vouchers only. Instead, you can use your points at any of Grab’s in-store merchants and for online purchases too, making it more flexible than traditional banks’ rewards points.

Pay With Points allows you to offset 50% or 100% of your transaction on GrabPay using your GrabRewards Points. However, the value of each GrabRewards point is significantly lower at 0.606 sen per point (RM1 for 165 points). In turn, it affects your rate of returns as such:

| Expenditure | GrabRewards Points | Rate of Returns |

| Purchases made in Grab app (including GrabPay e-wallet reloads) | 5x | 3.03% |

| E-commerce and overseas purchases | 2x | 1.22% |

| Eligible local transactions | 0.3x | 0.20% |

Pair It With GrabUnlimited: Earn Up To 6.5% Effective Returns

With up to 5% returns, the Maybank Grab Mastercard Platinum is a pretty solid card – even if you’re essentially tied at the hips to the Grab ecosystem. The biggest benefit of the card lies in its 5x points for Grab transactions – you also earn 5x points for GrabPay top-ups as well. (Incidentally, this also makes it the only Maybank card that offers rewards for e-wallet top-ups.)

Therefore, one way to maximise the benefits of this card is to use it exclusively to top up your GrabPay wallet with the Maybank Grab Mastercard, and then use GrabPay for other payment. Pair it with a subscription to GrabUnlimited (RM4.90/month), and you’re looking at an effective 6.5% returns!

Top up GrabPay using Maybank Grab Mastercard (5%) + Spend using GrabPay with GrabUnlimited (1.5%) = 6.5% effective

Of course, this is a best-case scenario where you are a GrabUnlimited user, spend using GrabPay, and redeem vouchers at the preferred 500 points = RM5 rate. For non-GrabUnlimited users, the effective returns drop quite considerably to 3.83% due to the reduced earn and redemption rates.

In addition, some GrabPay transactions do not earn points, such as scanning a non-GrabPay DuitNow QR code and bill payments on the Grab app – but with the Maybank Grab Mastercard Platinum, you’ll still be earning 3.35% (non-GrabUnlimited) to 5% (GrabUnlimited) from topping up GrabPay.

As you can see, the GrabUnlimited upgrade actually makes the Maybank Grab Mastercard Platinum more rewarding – which leads us to believe a revision to this card is probably on the cards. We’re sure the folks at Maybank and Grab are aware of this, but for now at least there’s no word on that happening yet, so there’s still time to enjoy the additional rewards.

Competition – Is It As Good As Other Cards With E-Wallet Rewards?

Now that we know that the Maybank Grab Mastercard Platinum can garner up to 5% returns, here’s the other important question: how does it fare against other credit cards that offer rewards for e-wallets? There are other cards such as the CIMB e Credit Card, which 3% on the 28th of every month.

For the heavy spenders, there’s also the Affin Duo cards where the Affin Cash Back Visa Card offers 3% cashback on online expenditure, including e-wallet reloads, capped at RM80 per month (provided you have an outstanding balance of RM3,000 and above from the previous month).

While offering lower return rates, these two cards’ benefits aren’t limited to just one e-wallet. Given how varied the choice of e-wallets are in the Malaysian market right now, it’s something to consider when making your decision.

Conclusion: For The Everyday GrabPay Users

All in all, the Maybank Grab Mastercard Platinum is the best companion that turbocharges your returns if GrabPay is your preferred e-wallet of choice, allowing you to earn up to 6.5% (5% from topping up and 1.5% via GrabUnlimited) on a range of daily expenses.

In fact, even if you actively use multiple e-wallets alongside GrabPay, the Maybank Grab Mastercard Platinum could cover your GrabPay use while you use other cards to double dip on other e-wallet usage. This optimises your returns – especially considering the 6.5% effective returns is almost 2x that of other cards that offer rewards on e-wallet top-ups. After all, the Maybank Grab Mastercard Platinum is free for life with no annual fees.

Comments (6)

Time to update the article again with the recent changes effective 1st April 2023

Hi, does it mean I will not get any reward points if I top up on other non-grab e-wallet apps?

Thanks for the explanation! great help

Weird? I see that the date of the article is 27th July 2022. But the only other comment here is 1 year ago.

????????

Is 27th July 2022 the latest revision maybe?

Yup, our original article was published over a year ago. We updated it on 27 July, taking into account the changes to Grab’s rewards system on GrabUnlimited.

Great Write Up.. Thank you so much for the explanation..