Alex Cheong Pui Yin

14th August 2023 - 3 min read

BigPay, the digital financial services arm of Capital A, aims to expand its business reach in the coming year by tapping into the lucrative travel segment in the ASEAN region. Specifically, it intends to commence business in Thailand this year, followed by Indonesia and the Philippines in early 2024 – adding on to its current operation and offerings in Malaysia and Singapore.

According to the chief executive officer of BigPay, Zubin Rada Krishnan, BigPay already has a strong local team in Thailand, ready to begin building customised solutions to address local customers’ pain points and needs. Meanwhile, in the Philippines, BigPay will partner with UnionDigital Bank – a fully digital bank that is the subsidiary of UnionBank – to introduce BigPay to users in the country.

Rada Krishnan shared that BigPay’s new expansion plans will enable the digital platform to introduce its range of existing financial products to more Southeast Asians, thereby improving their lives. These include its goal-based savings feature Stashes, credit, remittances, bill payments, insurance, and mobile top-ups.

“For example, we want to help Indonesians working in Malaysia to easily remit money to family back home, and help their family in Indonesia to invest that money, or provide them with credit when there’s a shortfall. In the long run, we will help small businesses in ASEAN to broaden their activities beyond their own borders with innovative and easily accessible financial services,” said Rada Krishnan, adding that other features – such as Stashes – will help Southeast Asians to cultivate a habit of saving money with ease.

In addition to the expansion plans in these countries, BigPay will also tap into the opportunities and ecosystem of Capital A’s travel superapp, the airasia Superapp, to drive its growth. “BigPay will power seamless payment experiences in airasia Superapp, making it easy for people in ASEAN to pay for their travel in a simple one-click journey. When customers need help with paying for big purchases, or for money on their travels – BigPay can offer accessible credit,” Rada Krishnan stated.

Rada Krishnan further noted that existing BigPay users are already able to benefit from a range of exciting and unique offers within the airasia Superapp – such as exclusive previews and priority access for airasia promos – but there are more perks in the pipeline that BigPay hopes to introduce soon.

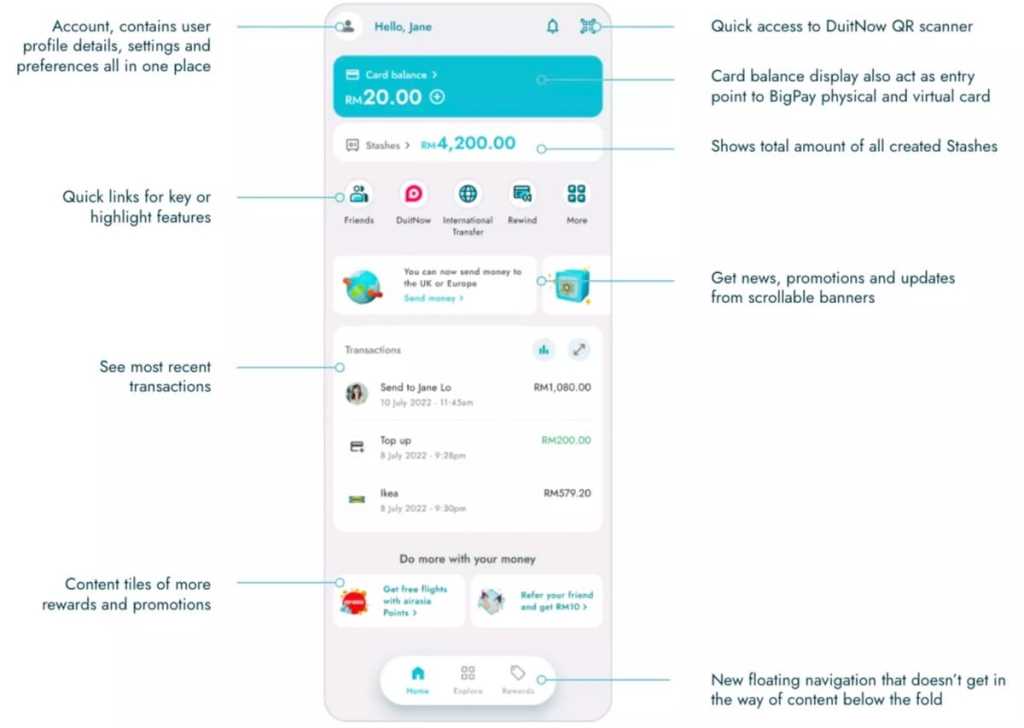

As for the advantages that BigPay has over its competitors, Rada Krishnan shared that the digital platform is focused on providing features that allow users full control over their finances with convenience. These include its financial feed that allow users to easily see their spending patterns and how they can better manage their cashflow. The newly revamped user interface also enables BigPay users to easily check the rewards that they’ve earned, including cashback, airasia Points, and exclusive deals.

Finally, Rada Krishnan believes that BigPay’s outlook is quite bright in the near future as travel has picked up significantly recently. Furthermore, the digital platform is able to piggyback on airasia’s developed ecosystem to serve customers in this segment within Malaysia and throughout the region.

“We believe that customers will continue to benefit from the innovation that BigPay and others in the fintech space will provide. As the focus of investors and stakeholders pivots to profitability over pure growth, we believe we will see the industry focusing on building truly differentiated offerings that customers will be willing to pay for,” said Rada Krishnan.

(Source: The Star)

Comments (0)