Alex Cheong Pui Yin

17th May 2023 - 3 min read

Maybank said that it has enabled Secure2u as the only verification method accepted for several more online transactions and banking activities performed on the Maybank2u website and the MAE by Maybank2u (MAE) app, including applications for EzyPay Plus and supplementary credit cards. More importantly, the bank also noted that it will fully migrate its Secure2u feature to the MAE app starting from 1 July.

In its notice, Maybank clarified that Secure2u will be the only authorisation method accepted for the following listed transactions:

| Platforms/Effective dates | Services | Transactions/Banking activities |

| Maybank2u website (starting 16 May 2023) | Credit cards | – Apply for EzyPay Plus – Add supplementary card |

| Unit trust | – Subscribe to unit trust – Top up unit trust fund | |

| Amanah Saham Nasional Berhad (ASNB) | – link an ASNB account (via “Wealth”) – Unlink an ASNB account (via “Settings”) | |

| WAQF | Apply for WAQF | |

| MAE app transactions (starting by the end of May 2023) | Scan & Pay | – Register for Scan & Pay – Adjust daily and cumulative limits |

| ATM cash-out | Set up ATM cash-out | |

| Settings | – Security: Change PIN – Profile: Change mobile number – Maybank2u: Change password and security question |

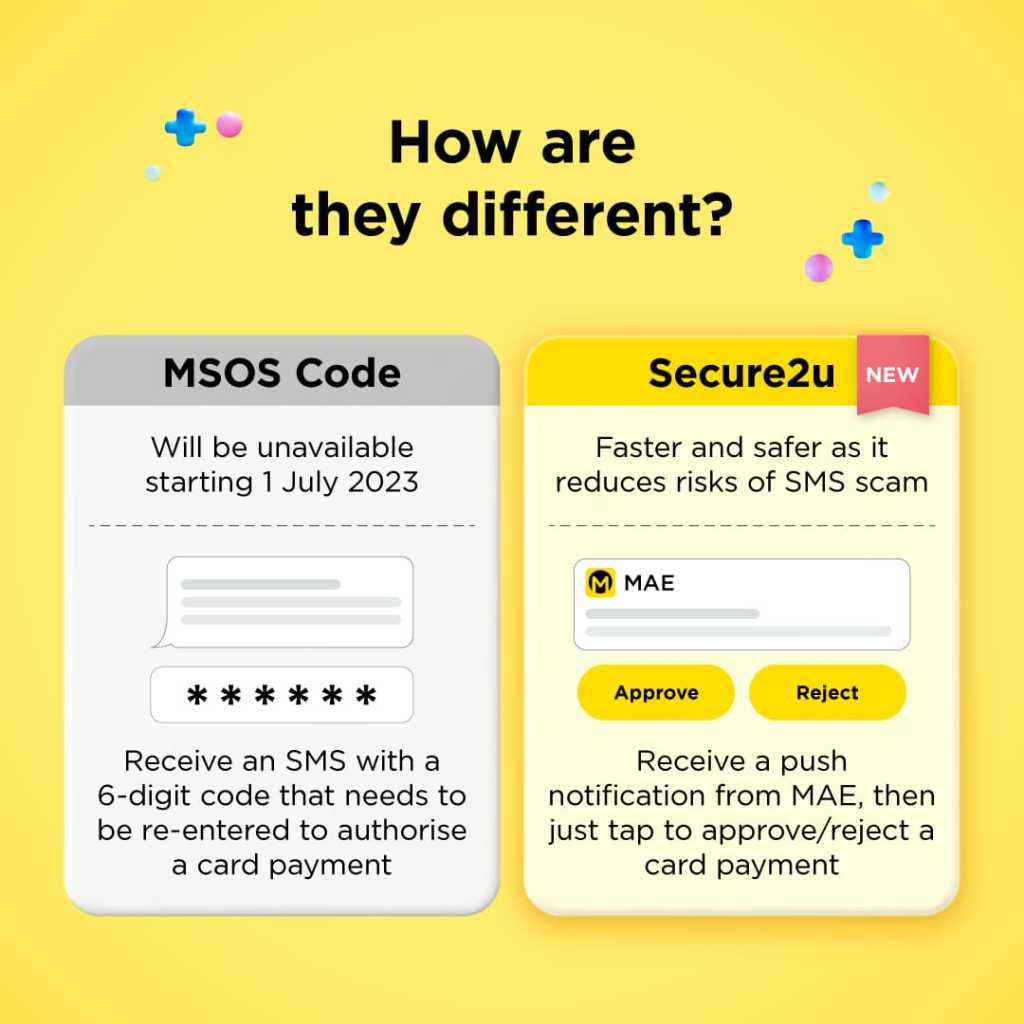

This latest development complements Maybank’s recent reminder that it is completing its migration to Secure2u for all online card transactions by 1 July. With this, customers will no longer receive Maybank Secure Online Shopping (MSOS) codes when they make online purchases using their credit or debit cards.

For those who are still unfamiliar, the MSOS code is essentially your SMS one-time password (OTP) that is sent via SMS to authorise a card payment. Meanwhile, Maybank’s Secure2u is said to be “faster and safer”, where you’ll receive a push notification from within your Maybank mobile banking app to approve or reject a card payment.

In addition to these updates, Maybank also highlighted that it will be fully migrating Secure2u to the MAE app starting from 1 July, making it the only app that carries the Secure2u function. This is as opposed to the current situation, where customers who had previously activated Secure2u on the Maybank2u app are still allowed to use the verification feature on the older app (although new activations of Secure2u have been permanently moved from the Maybank2u app to the MAE app since September 2022).

Essentially, this update means that all Maybank customers will soon have no choice but to switch over to the MAE app if they want to approve any online transactions. It is also in line with Maybank’s eventual plan to phase out the Maybank2u app, leaving MAE app as the the bank’s only mobile banking app.

If you need help on how to activate Secure2u on the MAE app, here’s a guide from Maybank to help you out with the process:

Do note that there will be a 12-hour cooling period once you’ve enabled Secure2u on the MAE app; you will not be able to use Secure2u to verify any online banking transactions or activities during this period. This is in an effort to better combat financial frauds, said the bank.

(Source: Maybank)

Comments (0)