Alex Cheong Pui Yin

28th May 2020 - 3 min read

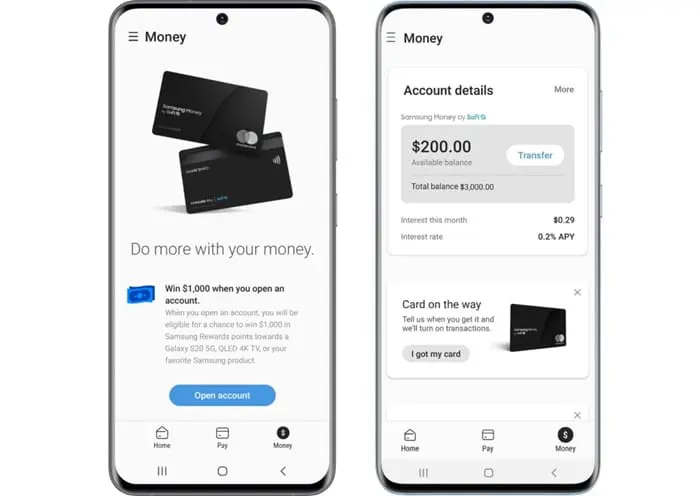

Samsung has introduced Samsung Money by SoFi, a mobile-first money management service that comes with a virtual and physical Mastercard debit card, as well as a cash management account. It is integrated with the company’s mobile payment and digital wallet service, Samsung Pay, expanding Samsung’s mobile payments ecosystem.

Customers will be managing the new service via Samsung Pay, which lets users check their account balance, view past statements, and search for transactions. Users can also conduct security processes such as flagging fraudulent activities, freeze or unfreeze their cards, and change their PIN number on the app without having to physically meet anyone. Additionally, there is no account fee, and customers who deposit money into the Samsung Money by SoFi cash management account will also earn interest.

Samsung Pay is also where users will initially set up Samsung Money by SoFi. Once the registration has been approved, users will get a virtual debit card instantly in the Samsung Pay app, while the physical card will be mailed, which is then activated using the app.

The Samsung Money by SoFi service also offers several other perks for users. For instance, purchases made with the Samsung Money by SoFi debit card will earn points via the Samsung Rewards programme. These points can be redeemed for cash, which will be deposited into the Samsung Money by SoFi account – similar to the Boost e-wallet here in Malaysia.

Another benefit includes being able to access 55,000 ATMs for free via the Allpoint network in the US. Samsung Money by SoFi accounts are also FDIC-insured (the US equivalent of PIDM) for up to $1.5 million – six times that of a normal bank account.

Security, too, is a top priority for Samsung Money by SoFi, thanks to protection from Samsung Knox, Samsung’s defence-grade mobile security platform used by the tech giant in its latest devices. The physical debit card is also designed with security in mind: the card number, expiration date, and CVC are all not displayed on the card. Instead, they can be found in the Samsung Pay app (just like the GrabPay Card and the Apple Card), and are further protected with biometric or PIN authentication.

“Samsung Money by SoFi is our biggest move yet to help users do more with their money. Samsung Pay is already the most rewarding shopping and payments experience driven by numerous innovations over the years. Now, users can access mobile-first financial services and earn exclusive Samsung benefits,” said the vice president and general manager of Samsung Pay (North America), Sang Ahn.

Samsung is yet another tech company making further inroads into financial technology, and follows companies like Google and Apple into expanding their existing mobile payments solutions (Google Pay & Apple Pay respectively) into fully-integrated money management tools that do not need the services of a bank. Huawei, too, recently entered the frame with the announcement of its Huawei Card, although these are both credit cards.

The Samsung Money by SoFi service will be available to Samsung smartphone users in the US in the coming months, with no word yet on international availability.

(Source: Samsung)

Comments (1)

This is not even for Malaysia…..why post it here?