Alex Cheong Pui Yin

23rd May 2022 - 2 min read

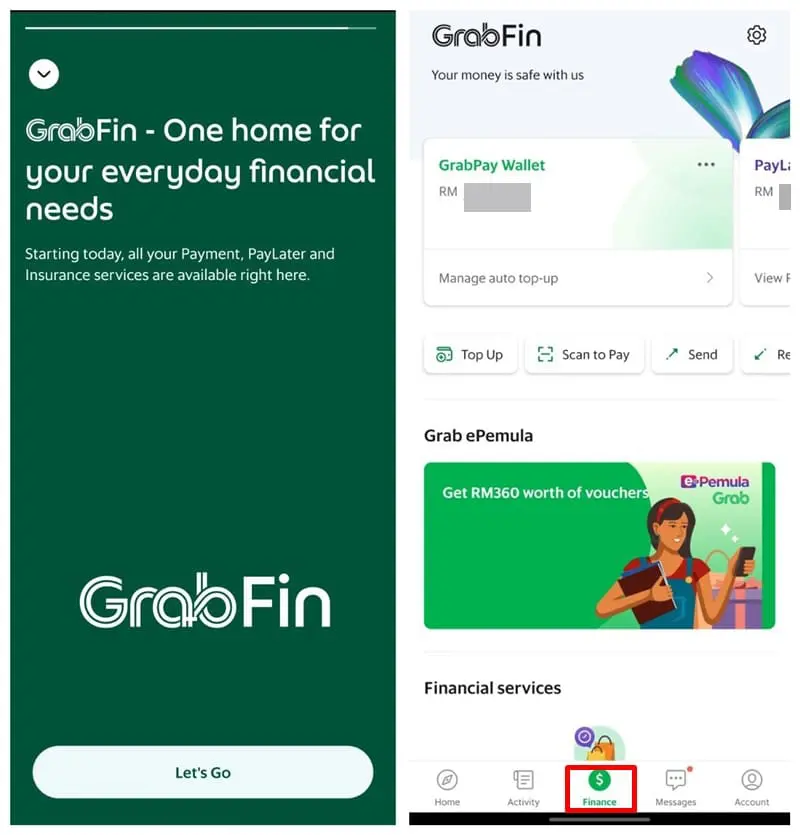

Grab Financial Group (GFG) has officially launched its new GrabFin brand for all users, which will cover its existing and upcoming digital payment, insurance, lending and wealth management solutions.

With this new brand, Grab said that all its financial offerings will be consolidated into one page on the Grab app, allowing users to conveniently access the services via one single entry point. This is following findings from a recent survey by Nielsen, which revealed that three out of five consumers prefer to access all their financial services on one integrated platform.

“The brand will offer everyday financial services that are simple to activate with just a few clicks in-app; fractionalised so more people can access the services; and flexible to enable consumers to choose how they use the products with no lock-in period,” said the head of GrabFin, Kell Jay Lim.

Lim also commented that with GrabFin, access to financial services will be “as simple as ordering a ride on the Grab app.” According to him, the customised products on GrabFin, as well as the multi-layered security features of GrabPay, will offer both flexibility and a peace of mind to Grab users.

Lim further said that the GrabFin brand represents the tech giant’s commitment to drive financial inclusion across the Southeast Asian region. “It reinforces our promise to empower the six in ten financially underserved in the region, by providing simple, accessible, and flexible financial services in a single platform that they are familiar with and already access daily,” he remarked.

Prior to this official launch, Grab had already been rolling out the GrabFin brand to its users, drivers, and delivery partners in stages since almost two weeks ago. Among some of the changes that were introduced include the Payment tab in the Grab app being replaced with a new Finance tab. The new tab will house all the relevant financial products for users, including Grab’s Travel Cover and Ride Cover. Grab drivers and delivery partners, too, will see financial products that are pertinent to them, such as the Grab Daily Insurance and Grab Cash Financing-i.

Grab was also recently named as one of the five successful applicants of Bank Negara Malaysia’s (BNM) digital banking licences. Other applicants who also made the cut include a consortium led by KAF Investment Bank, as well as a consortium between Boost Holdings Sdn Bhd and RHB Bank.

Comments (0)