RinggitPlus

3rd July 2013 - 3 min read

(Picture courtesy of of scottchan at FreeDigitalPhotos.net)

E-commerce is becoming the way for many to do business. The convenience is unsurpassed and

the cost savings afforded to sellers through lower overheads helps to drive

prices lower.

You can shop online with any credit card

but what about a little enticement? Some credit cards are now offering

incentives to encourage you to keep on clicking.

For internet shopping junkies

If internet shopping is the way you get

everything from hotel stays to new clothes; you would want to get a card that

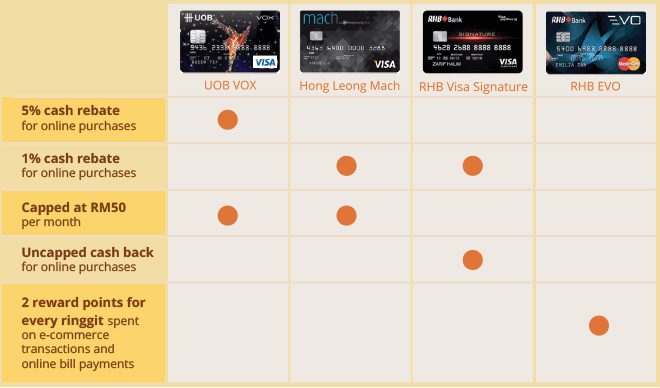

rewards you for doing the things you love. The UOB VOX

card gives an impressive 5% cash rebate for online purchases but this is capped

at RM50 per month. The Hong

Leong Mach credit card also gives cashback for online spends if the

category is one of your chosen (the card’s cashback works on selected

categories which cardholders are allowed to customise). However, the rate is 1%

for online purchases and the cap for all cashback receivable is RM50 per month

as well. The Mach card offers cashback in more spending while the UOB Vox is focused

on online spending.

For the higher income bracket, the RHB Visa

Signature offers 1% uncapped cashback for online spending. Those who do

virtually all their shopping online will benefit from the unlimited

cashback.

The RHB EVO

also rewards online shoppers with double reward points for every ringgit spent

on e-commerce transactions and bill payments made through the internet.

For the internet savvy traveller

If you’re the frequent traveller who

prefers to book tickets and hotels online; choose a travel card that not only

gives you travel benefits but also a card that understands your travel booking

style. The CIMB

Enrich Platinum and Gold

Mastercard cards are tied-in with MAS. Aside from earning points through

conventional spending methods you can also earn extra points by booking flight

tickets online. Normally you would earn 1.5 Enrich miles for every RM6 spent on

retail transactions but when you book your air tickets through MAS online

booking, you’ll earn one Enrich point for each ringgit you spend.

Similar to the CIMB Enrich cards, the Maybank

SIA Krisflyer allows you to earn extra airmiles. Every RM2 spent on normal

purchases earns you one Krisflyer mile, however if you book for your tickets

online through SIA you will receive 2 Krisflyer miles for every RM2 spent.

For everything else E

E-commerce benefits can be sporadic and

dependant on the card issuer’s agreement with specific online merchants. Online

shopping giants Zalora for instance offer rebates to specific cardholders for a

limited period: Currently, all RHB credit cards get a flat 15% discount on

shopping or an RM20 voucher for purchases of RM100; CIMB cardholders receive

20% storewide or 25% for purchases exceeding RM150; Standard Chartered credit

cards receive 15% storewide as well. As the biggest online fashion destination;

it’s a good rebate if you’re a fashionista (or one in the making).

There are then some issuers who encourage

you to use their online services because it reduces cost for them, which in

turn, benefits you. All HSBC credit

cards (except those under Islamic Banking) encourage reward point redemption

through their online portal as opposed to calling or heading to a branch. Using

the online method will save you 500 points off the redemption amount on

selected items.

Depending on the kind of online shopper you

are – you may want to consider a card which rewards you for doing what you

love.

Comments (0)