Best Credit Cards In Malaysia 2026

Most Malaysians carry at least one credit card, but not everyone is maximising what they could be earning back. Whether it's cashback on your RM3,000 monthly grocery bill, petrol rebates that actually cover your weekend trips to Penang, or air miles that get you to Bangkok for free, the right card makes a real difference to your wallet.

The question isn't whether you need a credit card. It's whether you're using the right one for how you actually spend your money.

What Is a Credit Card?

A credit card lets you buy things now and pay later, usually with benefits like cashback or rewards points. When you use a credit card, the bank pays the merchant on your behalf. You then pay the bank back, either in full by the due date (which is what you should aim for) or in smaller monthly payments if needed.

The real value of credit cards in Malaysia isn't just the convenience. It's the rewards. Use a cashback card for your RM800 monthly petrol bill, and you could get RM96 back every year. That's essentially a free tank of fuel, just for using the right card.

Credit Card Tiers in Malaysia

Credit cards come in different tiers based on income requirements and benefits:

Gold Mastercard/Visa cards, also known as Classic, are entry-level, usually requiring around RM2,000 to RM3,000 monthly income. These offer basic rewards and benefits.

Platinum Mastercard/Visa cards usually sit in the middle at around RM4,000 to RM5,000. Better cashback rates and more perks than Gold cards.

Premium cards (Signature, Infinite, World Elite) start from RM6,000 monthly income and come with perks like airport lounge access, higher cashback rates, and travel insurance.

The tier you qualify for depends on your monthly income, but higher tiers aren't automatically better. A Gold cashback card that perfectly matches your spending can give you more value than a Premium card with benefits you never use.

How Does a Credit Card Work in Malaysia?

Here's what you need to understand about how credit cards work in Malaysia, from fees to interest rates to what happens when you don't pay on time.

Annual Fee

Some credit cards charge you a yearly fee just for holding the card, anywhere from RM80 to RM800, depending on the card tier. Others are free for life.

Then there are cards with conditional waivers. These are free as long as you meet certain requirements. For example, a card might waive the RM168 annual fee if you swipe at least 12 times a year, or if you spend RM12,000 annually.

If you're a light spender who only uses your card occasionally, a lifetime free card makes more sense than trying to meet minimum spending requirements.

Interest Rate (Finance Charge)

If you don't pay your bill in full by the due date, the bank charges interest on whatever amount you still owe. This is where credit cards can get expensive if you're not careful.

In Malaysia, there are three tiers of interest rates based on how good you are at paying on time:

| Your Payment Track Record | Interest Rates | Monthly Rate |

| Paid on time for 12 months straight | 15% p.a. | 1.25% per month |

| Paid on time for 10-11 months out of 12 | 17% p.a. | 1.42% per month |

| Paid on time for less than 10 months | 18% p.a. | 1.50% per month |

What this means in real money: If you owe RM1,000 and you're in the highest interest tier (18% p.a.), you'll be charged about RM15 in interest that first month. Let that roll over for a year, and you're looking at RM180+ in interest charges on that original RM1,000.

The simple rule: Pay your bill in full every month. That way, you never pay a single sen in interest.

Interest-Free Period

This is your grace period, usually 20 to 25 days from when your statement is issued to when payment is due. During this time, you owe the bank money, but they're not charging you interest yet.

Example: Your statement comes out on 1st January, showing you spent RM2,000 in December. Your payment due date is 21st January. As long as you pay the full RM2,000 by 21st January, you pay zero interest. Miss that deadline and interest starts piling up.

This is why credit cards work well as financial tools for people who pay on time. You get up to 50 days of free credit (from the moment you buy something to the payment due date), plus whatever rewards the card offers.

Credit Limit

This is the maximum amount the bank will let you borrow on the card.

If you earn RM3,000 or less per month, your credit limit is capped at two times your monthly salary. So if you earn RM2,500, your maximum credit limit is RM5,000.

If you earn more than RM3,000 per month, there's no regulatory limit. The bank decides based on your income and credit history. Someone earning RM8,000 might get a RM30,000 limit, while another person with the same income but existing debts might only get RM15,000.

You can hold multiple cards from different banks with different limits. Just remember that higher limits aren't an invitation to spend more. They're for flexibility and emergencies.

Cash Advance

This feature lets you withdraw cash from ATMs using your credit card, but it's expensive.

Most banks charge:

- A cash advance fee (usually 5% of the amount withdrawn or RM15, whichever is higher)

- Interest at 18% p.a. starting immediately (no grace period)

- Daily interest calculation until you pay it back

Example: Withdraw RM1,000 cash from your credit card, and you'll pay:

- Immediate fee: RM50 (5%)

- Daily interest: RM0.49 (18% ÷ 365 × RM1,000)

- After 30 days: You owe RM1,064.70

Unless it's a genuine emergency, don't use a cash advance. The fees make it one of the most expensive ways to access cash.

Billing or Statement Cycle

Every month, your bank sends you a statement listing all your transactions from the previous month. This statement shows how much you spent, the minimum payment required (usually 5% of the total), the full payment amount, and the payment due date.

Example cycle:

- 1-31 Dec: You make purchases

- 1 Jan: Statement issued showing December spending

- 21 Jan: Payment due date

- 22 Jan onwards: If you haven't paid, interest starts

Mark your due date in your calendar. Missing it by even one day triggers interest charges and can affect your payment track record (which determines your interest tier).

Minimum Monthly Payment

You're allowed to pay just a portion of your bill, usually 5% of the total amount owed or RM50, whichever is higher.

Here's why minimum payments are a trap:

Say you owe RM5,000 on your card. Your minimum payment is RM250 (5%). If you only pay the minimum, the remaining RM4,750 gets hit with interest. At 18% p.a., you're charged roughly RM71 in interest that first month. Next month, you're paying interest on RM4,821 (the original balance plus the interest).

The actual cost: If you only ever pay the minimum RM250 monthly on a RM5,000 balance at 18% interest, it'll take you over 2 years to clear the debt, and you'll pay roughly RM1,400 in interest. That RM5,000 purchase actually cost you RM6,400.

Pay the minimum if you absolutely must, but have a plan to clear the full balance as soon as possible.

How to Choose the Right Credit Card

1. Evaluate Your Lifestyle: Are you a frequent online shopper, traveller, or driver?

2. Compare Categories: Look at rewards for dining, groceries, petrol, and e-wallet reloads.

3. Use RinggitPlus Tool: Our Credit Card Recommendation Service helps to match your salary, preferences, and financial goals.

Best Credit Cards 2026 in Malaysia by Category

Here are the top credit cards curated by category to help you find the one that best fits your spending needs and lifestyle.

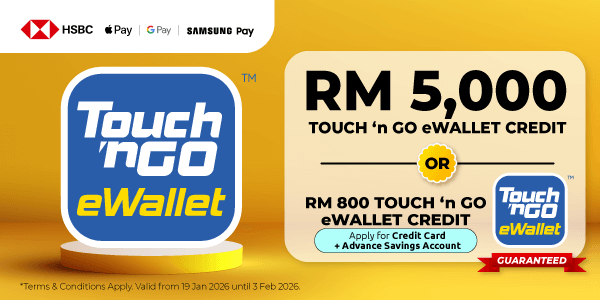

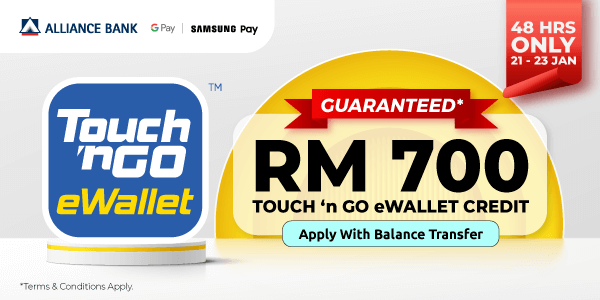

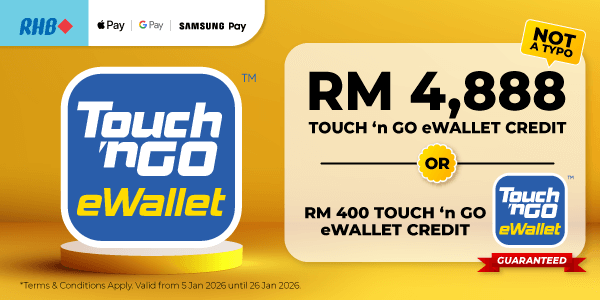

Sign-Up Offers

Apply for a credit card through RinggitPlus, and you can claim exclusive welcome gifts. Anything from shopping vouchers to kitchen appliances to cashback.

Browse the participating banks, compare what they're offering this month, and apply for the card that makes sense for your spending. Meet the minimum spending requirements (usually RM500 to RM1,500 within the first 30-60 days) and claim your gift.

The gifts change regularly, so check back if you don't see anything you want right now.

No Annual Fees Credit Cards

Why pay RM150-RM300 a year just to hold a piece of plastic?

No annual fee cards are free to hold, whether it's your first year or your tenth year. No minimum spending requirements to maintain the waiver, no yearly charges sneaking onto your statement.

These cards are particularly good if you're:

- Just starting out with credit cards and want to build your credit score without annual fee pressure

- A light spender who won't hit minimum spending thresholds for annual fee waivers

- Someone who wants a backup card for specific merchants or emergencies

"No annual fee" doesn't mean "no benefits". Plenty of these cards still offer cashback, rewards points, or merchant discounts. You just don't pay a yearly fee for the privilege.

Cashback Credit Cards

Every month, a portion of what you spent comes back to you as cash credited to your card account. No points to track, no redemption catalogues to browse. Just money back.

Cashback cards are the most popular type in Malaysia because they're straightforward and the value is immediate. Spend RM2,000, get RM40 back (at 2% cashback). Spend RM5,000, get RM100 back.

Two main types:

- Flat-rate cashback cards give you the same cashback percentage on everything, usually 0.5% to 1.5% on all spending. Simple, but lower returns.

- Category cashback cards give you higher cashback on specific categories (petrol, groceries, dining) and lower cashback on everything else. More effort to maximise, but better returns if you spend heavily in the right categories.

Example: You spend RM600/month on petrol. A flat 1% cashback card gives you RM6 back. A petrol-focused card giving 8% cashback gives you RM48 back. That's RM504 vs RM72 yearly, a RM432 difference.

The trick is matching the card's bonus categories to your actual spending habits.

Rewards Credit Cards

Instead of cashback, you collect points on every Ringgit spent. These points can be redeemed for shopping vouchers, gifts, dining discounts, or converted to air miles.

Rewards cards work well if you:

- Don't need the money immediately (points accumulate over time)

- Enjoy redeeming for specific items or experiences

- Want the flexibility to convert points to air miles when you're planning a trip

The main downside is that points can expire (usually after 2 to 3 years), and redemption catalogues can be hit-or-miss. If you forget to redeem your points, you get nothing. Cashback is simpler because the money comes back automatically.

That said, some premium rewards cards offer excellent point-to-air mile conversion rates, which can be more valuable than cashback if you travel regularly.

Petrol Credit Cards

If you drive regularly, a petrol credit card can save you hundreds of ringgit a year just by filling up at the same stations you already use.

These cards typically offer 8% to 12% cashback or rewards points specifically on petrol spending at partner stations (Shell, Petronas, BHP, Caltex). Some also include rebates on toll payments or car-related spending, like parking and car washes.

Example calculation:

- Monthly petrol spending: RM500

- Card cashback rate: 10%

- Monthly savings: RM50

- Yearly savings: RM600

That's RM600 back in your pocket annually, which essentially covers 1-2 months of free petrol.

The catch is you usually need to fuel at specific brands. Check which petrol stations you actually use before applying. A Shell card is useless if you always go to Petronas.

Travel Credit Cards

If you fly regularly (whether for work or annual holidays), travel cards can give you significant value through air miles, free airport lounge access, and travel insurance.

Air miles: Many travel cards let you convert your rewards points to airline miles with Malaysia Airlines, AirAsia, Singapore Airlines, or other frequent flyer programmes. Rack up enough miles, and you can redeem free flights.

Airport lounge access: Premium travel cards often include complimentary access to airport lounges (Plaza Premium, KLIA lounges, overseas lounges). Worth RM80-RM150 per visit if you were paying cash.

Travel insurance: Complimentary coverage when you book flights or travel packages using the card. Saves you RM100-RM300 per trip.

Foreign currency spending: Some cards don't charge foreign transaction fees (usually 1% to 3%), which saves money when you're spending overseas.

The value in travel cards comes from frequent use. If you only travel once a year domestically, a simple cashback card might serve you better. If you fly 4 to 5 times a year, including international trips, a travel card can save you thousands.

Islamic Credit Cards

Islamic credit cards work the same way as conventional cards. Swipe to pay, settle your bill monthly, earn rewards. The difference is in the underlying structure, which follows Shariah principles.

Instead of charging interest or riba (which isn't permissible in Islamic finance), Islamic cards use a Tawarruq contract. This is a buying and selling arrangement that achieves a similar economic outcome to interest, but structured in a Shariah-compliant way. Most Malaysian banks have migrated to this Tawarruq structure for their Islamic credit card products.

For the cardholder, the practical difference is minimal. You still get cashback, rewards points, and all the usual credit card benefits. You still need to pay your bills on time to avoid additional charges.

Islamic cards are suitable for Muslims who want to ensure their financial products align with their faith, but anyone can apply. There's no religious requirement.

Online Shopping Credit Cards

Online shopping cards give you boosted cashback or rewards when you buy from specific e-commerce platforms: Shopee, Lazada, Grab, Zalora, and others.

Typical benefits:

- Higher cashback rates (5-10%) on partner platforms

- Special discounts or vouchers exclusive to cardholders

- Bonus rewards points on online transactions

These cards make sense if you do most of your shopping online and tend to stick to one or two platforms. Someone who spends RM800/month on Shopee can earn RM40-RM80 back monthly with the right card (5-10% cashback), compared to RM8 with a standard 1% cashback card.

Check if the boosted rates apply to all online spending or just specific merchants. Some cards give high cashback only on selected platforms and much lower rates everywhere else.

Choose Credit Cards by Bank

Already have a preferred bank? Use the bank filter to see all credit cards from a specific bank at once.

This is useful if you:

- Want to consolidate all your accounts with one bank for easier management

- Have existing relationship benefits (like higher credit limits or faster approvals)

- Trust a particular bank's customer service or online banking platform

- Are looking for a supplementary card to your existing primary card from the same bank

Local Banks: Maybank, CIMB, Public Bank, Hong Leong Bank, RHB, AmBank, AFFIN Bank, Alliance Bank, BSN, Bank Rakyat

Islamic Banks: Bank Islam, AFFIN Islamic Bank, HSBC Amanah, Public Islamic Bank

International Banks: HSBC, Standard Chartered, UOB, OCBC, ICBC

Others: AEON Credit Service

Each bank has different strengths. Some excel at cashback cards, others at travel rewards or premium benefits. Browse by bank to see their full range.

Frequently Asked Questions (FAQs)

1. How many types of credit cards are there in Malaysia?

Malaysia has four (4) biggest card networks or card schemes: Visa, Mastercard, American Express, and UnionPay. They partnered with Malaysian banks to issue credit cards to consumers.

The banks then further categorised these cards to meet various consumers’ needs and spending habits by having features such as cashback, reward points, or air miles.

- Cashback: You get back a portion of the money you have spent in your account.

- Rewards: You earn loyalty points for every Ringgit spent, redeemable for products and services.

- Air Miles: You earn loyalty points for every Ringgit spent, redeemable at your frequent flyer programs.

Essentially, a credit card will have one of the features above.

Depending on the income band, it can have a combination of features such as cashback and rewards or air miles and cashback.

2. What is the minimum salary needed for a credit card in Malaysia?

Bank Negara Malaysia (BNM) requires a minimum annual income of RM24,000 (RM2,000 per month) for first-time applicants. However, different cards have different requirements; hence, some need RM8,500 per month for premium cards.

3. How many credit cards can I apply for?

BNM has stated that for those earning RM3,000 or less, you can own a maximum of two credit cards from two different banks, with a combined limit of two times your salary.

Anyone with a monthly income above RM3,000 may own multiple credit cards from multiple issuers, subject to your credit background and the bank's approval requirements.

4. How do Islamic credit cards work?

Islamic credit cards in Malaysia follow Syariah-compliant principles. Instead of charging interest (riba), they apply a fixed profit rate called Ujrah. Additionally, many Islamic credit cards include complimentary Takaful (Islamic insurance) for accidents, death, or total permanent disability.

5. What is cashback, and how does it help save money?

Cashback is one of the easiest ways you can get extra value from everyday spending. When you use a cashback credit card, you’ll receive a small percentage of the money you spend credited back to your account. Most cashback credit cards in Malaysia offer rebates between 1% to 15%, depending on the spending category and monthly conditions.

However, keep in mind that cashback is usually subject to: Monthly caps (e.g., up to RM30 or RM50 cashback per month), Minimum spend requirements (e.g., RM500 or RM1,000 per month), and Specific categories only (like dining, petrol, online spend).

6. What happens, financially and legally, if I miss a payment?

Failing to pay your credit card balance on time triggers immediate financial penalties and long-term damage to your credit health.

- High Interest Charges (Finance Charge): You will be immediately charged the highest annual interest rate of 15% to 18% (Tier 3), which is compounded daily on the outstanding balance.

- Late Payment Fees: Banks will apply a mandatory late payment fee, which is typically between RM10 and RM100, or a maximum of 1% of the total outstanding balance (whichever is lower).

- Credit Score Damage: Your late payment is officially reported to the Central Credit Reference Information System. A poor payment record will cause future loan or credit card applications (for housing, car, or personal loans) to be heavily scrutinized, delayed, or outright rejected for several years.

7. What is a CCRIS report, and how can I get it online?

The Central Credit Reference Information System (CCRIS) is a system that records your credit history for banks to assess your credit risk. You can get your free report online through the eCCRIS portal, but registration is required if this is your first time accessing it. You can also obtain it via approved credit reporting agencies or at CCRIS kiosks in AKPK branches. Only authorised individuals may request reports for businesses or deceased persons.

8. What is a cash advance, and should I use it?

A cash advance lets you withdraw cash from an ATM using your credit card. Don't do it unless it's an emergency. You'll be charged:

- Withdrawal Fee: A flat fee is applied instantly, usually 5% of the total amount withdrawn.

- Zero Grace Period: Interest starts accruing immediately from the moment of withdrawal.

- Highest Interest Rate: The interest charged is typically the highest tier, 18% per annum, calculated daily until the entire withdrawn amount is paid back.

9. How can I avoid paying the annual fee on my credit card?

Most credit cards waive the annual fee if you meet one of two common conditions:

- Minimum Annual Spending: You spend a predetermined total amount per year (e.g., RM10,000 for entry-level cards or up to RM24,000 for premium cards).

- Minimum Transactions: You make a specific, low number of transactions within the year (e.g., 12 swipes/purchases per year, which translates to just one purchase per month).

Always check your specific card's waiver conditions and set a reminder a month before your renewal date to ensure you have met the requirement!

10. Can I apply for a credit card if I'm currently in my probation period?

It is generally difficult, but not impossible. The flexibility depends on the bank and the card type:

- Higher Flexibility: Institutions that aggressively target entry-level applicants, such as RHB and Alliance Bank, are known to be slightly more lenient, especially if you meet the minimum income and provide a clear letter of employment/offer.

- Best Strategy: If you have salary savings, the Secured Credit Card (backed by a Fixed Deposit) is your safest bet. Since the bank holds collateral, your employment status becomes secondary, and approval is nearly guaranteed regardless of your probation status.

How to Apply for a Credit Card (3 Simple Steps)

The application steps are simple, and you can apply in just 10 minutes or less from the comfort of your home.

Step 1: Check Your Eligibility

- Monthly income meets the card requirement

- Age 21 and above

- Malaysian citizen or permanent resident

Use our comparison tool to pick a card, or click the "Chat on WhatsApp" button to try our Credit Card Recommendation Service.

Step 2: Gather Your Documents

- IC (MyKad)

- Latest 3 months' payslips or EA form

- Bank statements (if self-employed)

Step 3: Apply Online

- Click "Apply Now" on your chosen card

- You'll be redirected to our secure WhatsApp chatbot

- Answer a few questions

- Submit your application

- Bank will contact you within 3-7 working days

Should you have any questions regarding your credit card application, reach out to us at [email protected].

Exclusive Credit Card Sign-Up Offers and Weekly Gifts

Besides earning great rewards and cashback from your new card, you can unlock immediate value by taking advantage of our high-value gifts and exclusive promotions.

RinggitPlus frequently rewards new applicants with special offers when you apply through our platform. Keep an eye on the dedicated promotions page below to see all the latest deals and exclusive sign-up gifts this week!

See All Current Offers: https://ringgitplus.com/en/credit-card/sign-up-offers/

Best Credit Card Promotions in Malaysia (2026 Ongoing Offers)

Credit cards are useful if you know how to use them wisely. Besides giving you a rewarding spending experience with all the reward points or cash rebates, etc. to collect, you can also enjoy numerous ongoing deals, promo codes, and discounts at participating merchants all around Malaysia.

In the tables below, you will find the latest deals, discounts, and offers from your favourite credit cards so you can maximise your savings.

Keep a tab on this section, as this list will be updated monthly.

[Updated: 2 January 2026]

|

FOOD AND DINING PROMOTION |

|||

| Bank | Merchant | Promotion | Expiry Date |

| AEON | Baskin Robbin | Buy 1, Free 1 on a single regular scoop | 31 Mar 2026 |

| AmBank | Mokky's Pizza and Coffee | 10% OFF total bill (Minimum RM70) *Valid for AmBank Visa credit cards only |

31 May 2026 |

| AFFIN Bank | Yolé | 10% OFF total bill |

14 Sept 2026 |

| Bank Islam | GrabFood/GrabCar | RM5 OFF Promo code: BIMB5 (Minimum spend RM30) *Valid for transactions made via the Grab app Limited to the first 750 redemptions per month for both |

30 June 2026 |

| CIMB | Nando's | 10% OFF total bill | 31 Apr 2026 |

| HSBC | Aburii | 15% OFF on Japanese Omakase Course Menu *Valid for dinner session only (6:00pm – 10:30pm) | 31 Oct 2026 |

| Hong Leong Bank | myBurgerLab | RM10 OFF total bill Promo code: MLBXVISA10 (Minimum spend RM50) |

30 Apr 2026 |

| Maybank | Oriental Kopi | RM10 OFF total bill Limited to the first 7,600 redemptions *Valid for Maybank & Maybank Islamic Cards |

28 Feb 2026 |

| UOB | US Pizza | 50% OFF on regular traditional pizza Promo code: UOB50 | 31 Mar 2026 |

| SHOPPING PROMOTION |

|||

|

Bank |

Merchant | Promotion | Expiry Date |

| AEON | Shopee | RM30 OFF (Minimum spend RM60) *Valid for AEON Mastercard only | 31 Mar 2026 |

| AmBank | Casetify | 12% OFF Promo code: 15VISA | 31 May 2026 |

| AFFIN Bank | Christy Ng | 12% OFF (Minimum spend RM100) Promo code: 25AFFCN12 |

30 Sept 2026 |

| BSN | Rip Curl |

20% OFF Promo code: RCMC20 *Valid for BSN Mastercard Credit Card |

28 Feb 2026 |

| CIMB | Poh Kong | RM50 OFF on Diamond and Gem (Minimum spend RM500) | 31 Oct 2026 |

| HSBC | Book Xcess | (Minimum spend RM120) Promo code: HSBCBX06P8YCNSJNT3 | 30 June 2026 |

| Hong Leong Bank | Motherhood | RM25 OFF Promo code: MMYVISA50 (Minimum spend RM100) | 31 Mar 2026 |

| Maybank | Kapten Batik | 10% OFF normal-priced items on website Promo code: KBMBB10 |

31 Dec 2026 |

| Standard Chartered |

GARMIN |

Up to 40% OFF GARMIN wearables *Valid for Standard Chartered Priority Banking cardholders | 31 July 2026 |

| UOB | Zalora | 12% OFF Promo code: UOBZAL2026 (Minimum spend RM250) *Capped at RM100 |

31 Dec 2026 |

|

HOTEL AND TRAVEL PROMOTION |

|||

| Bank | Merchant | Promotion | Expiry Date |

| Affin Bank | Royal Chulan | Up to 20% OFF for hotel bookings

Promo code: AFFROYALE20 | 15 July 2026 |

| Alliance Bank | Sky Suite Airport Lounge | 20% OFF Promo code: VISA *Valid for Alliance Bank Credit Card & Visa Virtual Credit Card |

31 Mar 2026 |

| AmBank | RedBus | 45% OFF on bus and ferry ticket bookings via website Promo code: RBVISA |

31 May 2026 |

| BSN | Berjaya Hotels and Resorts | 20% OFF Room Category 30% OFF Suite Category *Valid for All BSN Credit Card/-i |

30 June 2026 |

| CIMB | Imperial Lexis |

Up to 15% OFF on dining, room stay, and spa treatment |

16 Sept 2026 |

| Hong Leong Bank | TUI BLUE The Haven Ipoh | 10% OFF on selected rooms Promo code: VISA *Blackout dates apply | 30 Nov 2026 |

| HSBC | Grand Lexis Port Dickson | Promo code: HSBC25B *Valid for selected HSBC Bank/HSBC Amanah Visa Credit Card/-i |

30 Nov 2026 |

| Maybank | LEGOLAND | 40% OFF for Theme Park + SEA Life + Water Park 40% OFF for Theme Park + SEA Life 40% OFF for Theme Park |

16 Apr 2026 |

| Standard Chartered | EQ Hotel | 30% OFF on the best available rate *Valid for VISA Infinite Privilege cardholders |

31 Aug 2026 |

| UOB | Expedia | 7% OFF for hotel bookings via website Promo code: UOBMY7 |

31 Dec 2026 |

What You Get With RinggitPlus

Compare cards based on how you actually spend. Instead of browsing hundreds of options, filter by what matters to your wallet: petrol cashback rates, grocery rewards, air miles conversion, or dining benefits.

Our comparison shows you the full picture for each card. Annual fees, cashback caps, income requirements, and actual returns based on your spending patterns. You can see which RM600/month petrol spend earns you RM48 back (8% card) versus RM6 (1% card), then decide if the higher-earning card's annual fee is worth it.

Check your eligibility before applying: Use our WhatsApp recommendation tool to see which cards match your income and credit profile. Helps you avoid wasting applications on cards likely to reject you.

All costs shown upfront: Annual fees, cashback caps, minimum spending requirements, and interest rates are listed for every card. No fine print surprises.

Current sign-up offers: Some banks run sign-up promotions through RinggitPlus (shopping vouchers, appliances, cashback). Check what's available this week before you apply.

Need help deciding? Chat with our Cards Assistant on WhatsApp at +603-90780880, email [email protected], or browse our comparison guides. We're here to help you find the right card for your spending, not just the most popular one.