Best Credit Cards In Malaysia 2024

Do you have a hard time choosing a credit card? From cashback, travel, and no annual fee credit cards, which to choose?

A credit card is a great financial tool but at the same time, it wouldn't be as great if it doesn't add some value to your lifestyle.

While you may already have a card preference in mind, it's still good to 'shop' around first to get an idea of which type of credit card is best for you to use daily.

Which credit card is the best for everyday Malaysians?

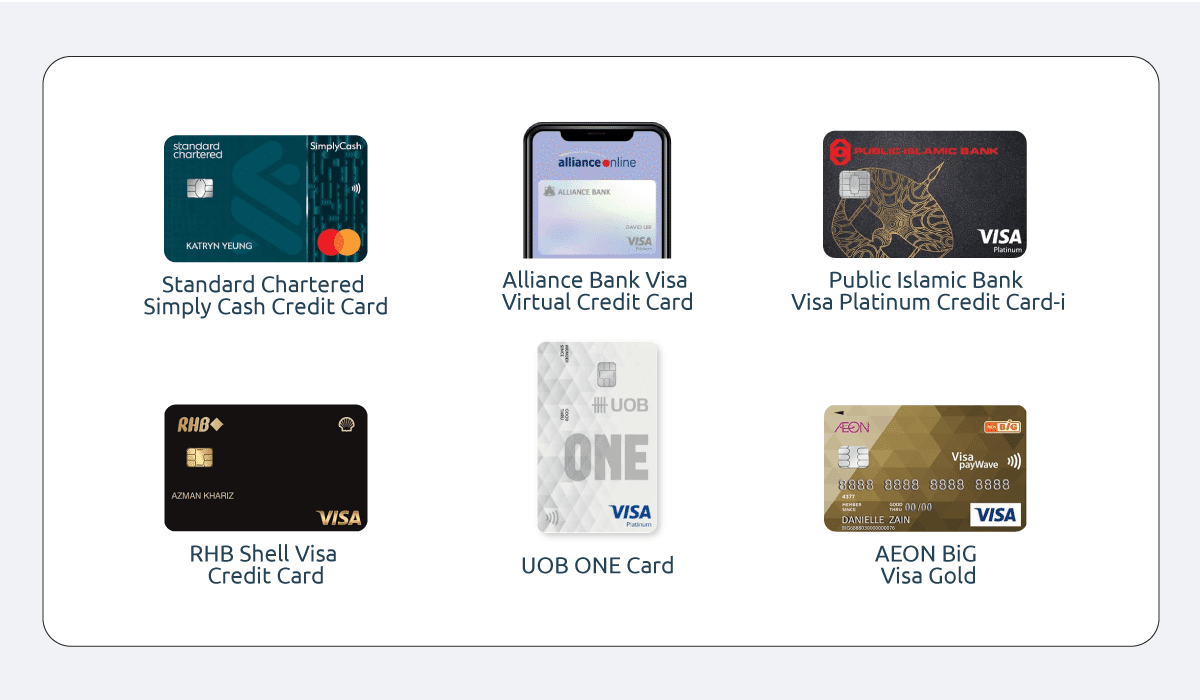

Of all the credit cards available on the RinggitPlus comparison platform, we recommend the top six that might fit everyone's preference.

- Standard Chartered Simply Cash Credit Card: Up to 15% cashback monthly on petrol, groceries plus dining, and e-wallet spending

- Alliance Bank Visa Virtual Credit Card: Up to 8x Timeless Bonus Points on online shopping and e-wallet spending, including other selected categories

- Public Islamic Bank Visa Platinum Credit Card-i: 2% cashback on online spending and overseas transactions

- RHB Shell Visa Credit Card: Up to 12% cashback monthly on petrol spending at Shell stations, and up to 5% cashback on grocery, online, e-wallet reload and utility spending

- UOB ONE Card: Up to 10% cashback on petrol, dining, selected grocers and Grab spending

- AEON BiG Visa Gold: 5% cashback on petrol spending every Sunday, and shopping during AEON Thank You Member Day (every 28th of every month)

What is a credit card?

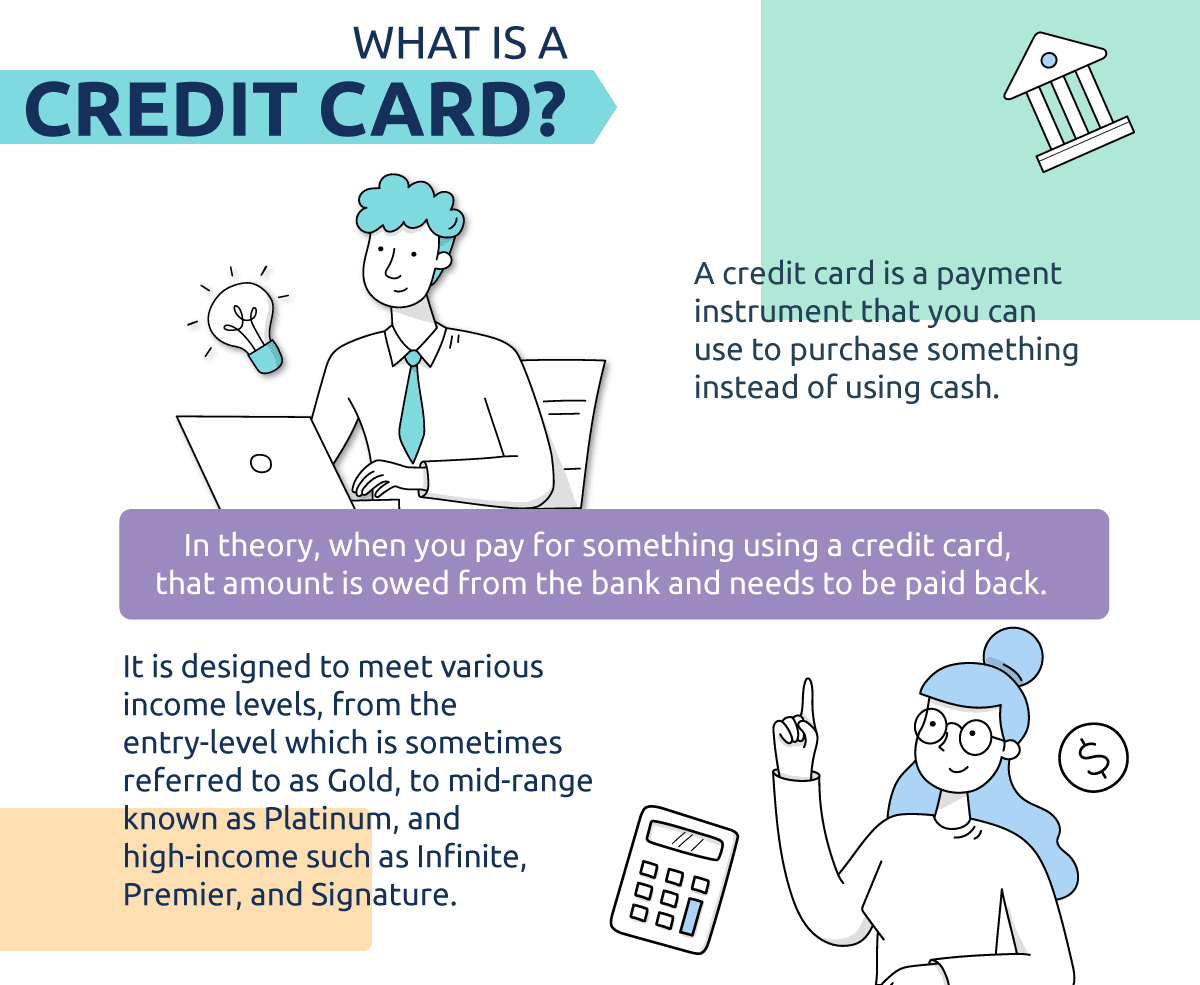

A credit card is a payment instrument to purchase something instead of cash. In theory, when you pay for something using a credit card, that amount is owed from the bank and needs to be paid back.

It is designed to meet various income levels, from the entry-level also referred to as Gold, to mid-range known as Platinum, and high-income such as Infinite, Premier, and Signature.

How does a credit card work?

Think of it like a fast loan that you can pay back when your salary kicks in. To understand more about how it works, let’s take a look at the basic features such as follows:

Annual fee

A credit card has a fee that is charged annually to the card members for the benefits that come with it.

Some of them don’t have an annual fee, whereas there are also cards with an annual fee waiver condition.

For example, a bank might offer an annual fee waiver simply by swiping your credit card at least 12 times in a year or some might require you to meet a certain spending amount in a year to get the waiver.

Credit card interest rate on purchases

This may not be theoretically correct, but banks charge interest on the outstanding amount as a penalty for borrowing their money and not repaying it on time.

A credit card interest rate or a finance charge, is usually charged on the outstanding balance amount when it is past due.

For example, if you have used up RM300 on your card and failed to settle it within the 20-day interest-free period, an interest rate of between 15% to 18% per annum will be levied on that amount.

In Malaysia, there are three tiers of credit card annual interest rates chargeable on the outstanding balance based on the cardholders’ repayment habits:

| Interest Rates/Finance Charges | Descriptions |

| 15% per annum (1.25% per month) | Tier 1: For cardholders with prompt payments for 12 consecutive months |

| 17% per annum (1.42% per month) | Tier 2: For cardholders with prompt payments for 10 months or more in the last 12-month cycle |

| 18% per annum (1.50% per month) | Tier 3: For cardholders with payments of less than 10 months in a 12-month cycle |

If you consistently pay your card bills in full and on time, then you don't have to worry about interest rates at all.

Interest-free period

This is a grace period whereby you can enjoy zero interest on your outstanding balance.

This period starts from the date of issuance of your credit card statement until the statement's due date.

Credit limit

This is the maximum amount that a lender can extend to you for a particular line of credit.

If you earn a monthly income of RM3,000 or less, the bank will usually set a credit limit of two times your salary.

For those earning more than RM3,000 a month, there is no limit to the credit that will be assigned to you. You can also own multiple cards from multiple banks with varying credit limits.

Cash advance

A cash advance is a facility that allows you to withdraw money from your credit card through an ATM much like a debit card.

Not to be confused with a cash loan facility whereby you can borrow a certain amount from your card and repay it in instalments, which is similar to an EPP.

A cash advance is subject to a cash withdrawal fee and interest rate of 18% per annum, which is calculated daily until you pay up the withdrawn amount in full.

Billing or statement cycle

Each credit card transaction you make will be posted on your credit card statement.

This statement, which itemises all your transaction histories for the past month, will arrive in your mailbox or inbox in the current month.

It is important to take note of the statement due date so that you will not be charged with unnecessary finance charges on the outstanding balance.

Minimum monthly payment

In your statement cycle, you are allowed to make a partial repayment of your credit card bill to avoid being charged a late finance fee on the outstanding balance.

However, the remaining amount of your outstanding balance will still incur a finance charge.

The minimum monthly payment is usually 5% of the total outstanding balance, which must be settled before the statement's due date.

How many types of credit cards are there in Malaysia?

Malaysia has four (4) biggest card networks or card schemes: Visa, Mastercard, American Express and UnionPay. They partnered with Malaysian banks to issue credit cards to consumers.

The banks then further categorised these cards to meet various consumers’ needs and spending habits by having features such as cashback, reward points or air miles.

Cashback: You get back a portion of the money you have spent in your account.

Rewards: You earn loyalty points for every Ringgit spent, redeemable for products and services.

Air Miles: You earn loyalty points for every Ringgit spent, redeemable at your frequent flyer programs.

Essentially, a credit card will have one of the features above.

Depending on the income band, it can have a combination of features such as cashback and rewards, or air miles and cashback.

What is the minimum income for a credit card application?

The minimum income for a first-time applicant is RM24,000 annually, according to Bank Negara Malaysia (BNM). Regardless, banks will require proof of income to qualify you as a credit cardholder.

Additionally, you must also have a valid identity card, employer letter of confirmation and other documents to support your application.

However, not all banks have the same income requirement for the same card type. For example, a Gold credit card by Bank A is offered to those with a monthly salary of RM3,000 and above, whereas Bank B opens to anyone earning a minimum of RM2,000 per month.

Therefore, make sure to compare credit cards from different banks to suit your annual or monthly income.

How many credit cards can I apply for?

There is no limit to the number of credit cards you can apply for from any bank. However, your chances of getting approved depend on your income and other factors such as your credit background.

BNM has stated that for those earning RM3,000 and less, you can own credit cards from a maximum of two different card issuers, with a credit limit capped at two times your monthly salary. However, whether you get this amount still depends on the banks you choose.

For anyone with a monthly income above RM3,000, you may own multiple credit cards from multiple issuers, subject to your credit background and the bank's approval requirement.

What happens if I fail to repay my credit card on time?

If you miss your payment, a finance charge between 15% to 18% per annum will be charged to your outstanding balance and will be compounded daily until you pay off the overdue amount.

Will my late payment affect my CCRIS report?

Unfortunately, yes. A late payment habit hurts your CCRIS record.

CCRIS or Central Credit Reference Information System stores information about your credit history, which is referenced by all banks when evaluating your credit risk.

Other than hurting your CCRIS record, you will also have a lower credit score and reduce your chances of getting approved on any loan application.

How do I check my CCRIS report and can I get it online?

According to BNM, you can request to obtain your personal CCRIS report online via the eCCRIS portal but a registration is required if this is your first time accessing it.

You may get your credit report via any credit reporting agency such as Experian, or visit the CCRIS kiosk at any AKPK branch near you as an alternative.

As a side note for business owners and deceased individuals, only authorised person(s) can request access to the credit report.

Which credit card should I get?

From credit cards with no annual fees to cashback cards, the choice is quite a handful but it's all up to your needs and preferences.

At RinggitPlus, we have several categories that can cater to the unique needs of every Malaysian.

Tips: If you can't decide which credit card works best for you based on your preference and income, we can help you through our credit card recommendation service (it's free!).

Credit card with sign-up offers

It doesn't matter if this is your first time applying for a credit card or if you're looking for a new credit card from a different bank, RinggitPlus rewards you abundantly with attractive sign-up gifts every week!

Browse through the participating banks, compare and apply for the selected credit card(s), meet the requirements accordingly and then claim your gift!

No annual fee credit card

First-year free? Free for a lifetime? Annual fee waiver? You bet that we have them all on RinggitPlus.

Credit cards without annual fees are often the preferable choice among Malaysians, it's even better for first-timers as you get to build your credit score without having to worry about paying extra money on annual fees.

Cashback credit card

Get cash back into your card account on every eligible spending, every month!

Typically the most popular choice among credit card users in the market, credit cards that earn you cashback aren't just rewarding but they can help you save more as well.

If you're a big spender on grocery shopping, petrol fueling or online shopping, for example, you might want to consider a cashback credit card for your expenses.

Other types of spending criteria are available for cashback as well, such as utility payments and dining.

Credit card with reward points

Such as its category name, every swipe of your credit card earns you attractive rewards points, also known as loyalty points.

Take note of the eligible spending, and swipe or tap away to collect rewards points!

Thereafter, the accumulated rewards points can be used to redeem gifts, shopping vouchers, dining coupons, air miles conversions and many more.

Petrol credit card

Perfect for individuals who are always on the road and are looking to maximise their petrol spending even further.

Petrol prices in Malaysia nowadays aren't exactly pocket-friendly. But with a petrol credit card, you get to earn rewards points, cashback or air miles just by spending on petrol.

Plus, certain petrol credit cards may also give you special discounts on car polishes, parts or accessories.

Credit card for travel

Specially tailored for frequent flyers from all walks of life, this type of credit card can help you save some money on your travelling expenses.

From rewards points, cashback, special discounts, complimentary access to airport lounges, and free travel insurance — you name it — you may get them all with a travel credit card.

Islamic credit card

This type of credit card category isn't as complicated as it may sound — it works the same as the conventional ones. The only difference is the spending criteria whereby they must be Shariah-compliant.

Hence, it is suitable for those ethical spenders! All faiths are welcome to apply for an Islamic credit card.

Air miles credit card

As its category name suggests, air miles credit cards are perfect for frequent flyers or travellers.

With this type of credit card in hand, you can convert the rewards points you've collected on eligible spending to air miles for a variety of frequent flyer programs from different airlines.

Collect as many air miles as you can, you might even fly for free. Who knows?

Credit card with airport lounge access

If you've always wanted to chill at the airport lounge (like the Plaza Premium Lounge, for example) when you're travelling, do you know that you can get complimentary access to it with a credit card?

You can and we're not bluffing. Simply follow through with certain spending criteria or other terms applicable, you might just be eligible for the complimentary access.

Credit card for online shopping

Special for shopaholics who have a con fashion (confessions).

Why not maximise your online spending while you're at it with a credit card for online shopping? You can get rewarded with either cashback or rewards points.

Cashback helps you save money, while rewards points let you redeem gifts, vouchers and more. Decisions, decisions.

Credit card for movie promotions

Movie buff, do you know that you can enjoy exclusive movie promotions, discounts or cashback with a credit card?

Movie tickets can be expensive at times, not to mention if you purchase them in sets. So why not make use of this type of credit card to help you save more?

Other than movie promotions, certain credit cards also earn you reward points for other eligible spending too.

Premium credit card

Curated for the VIPs and high-net-worth individuals! Also called black cards, this type of credit card not only comes with higher annual income requirements but also offers much more attractive benefits.

From golf benefits, to travel benefits and other exclusive privileges, premium cards are designed to elevate your lush lifestyle to the next level.

How can I get a credit card?

You can get a credit card by visiting the bank of your choice or through an online application.

There are about nineteen banks in Malaysia offering credit cards for various consumers with unique appetites through seamless online applications. They are:

- HSBC

- Public Bank

- RHB

- Standard Chartered

- UOB

- AEON Credit Service

- Affin Bank

- Affin Islamic Bank

- Alliance Bank

- AmBank

- BSN

- Bank Islam

- Bank Rakyat

- CIMB

- Hong Leong Bank

- ICBC

- Maybank

- OCBC

Can I apply for a credit card with RinggitPlus?

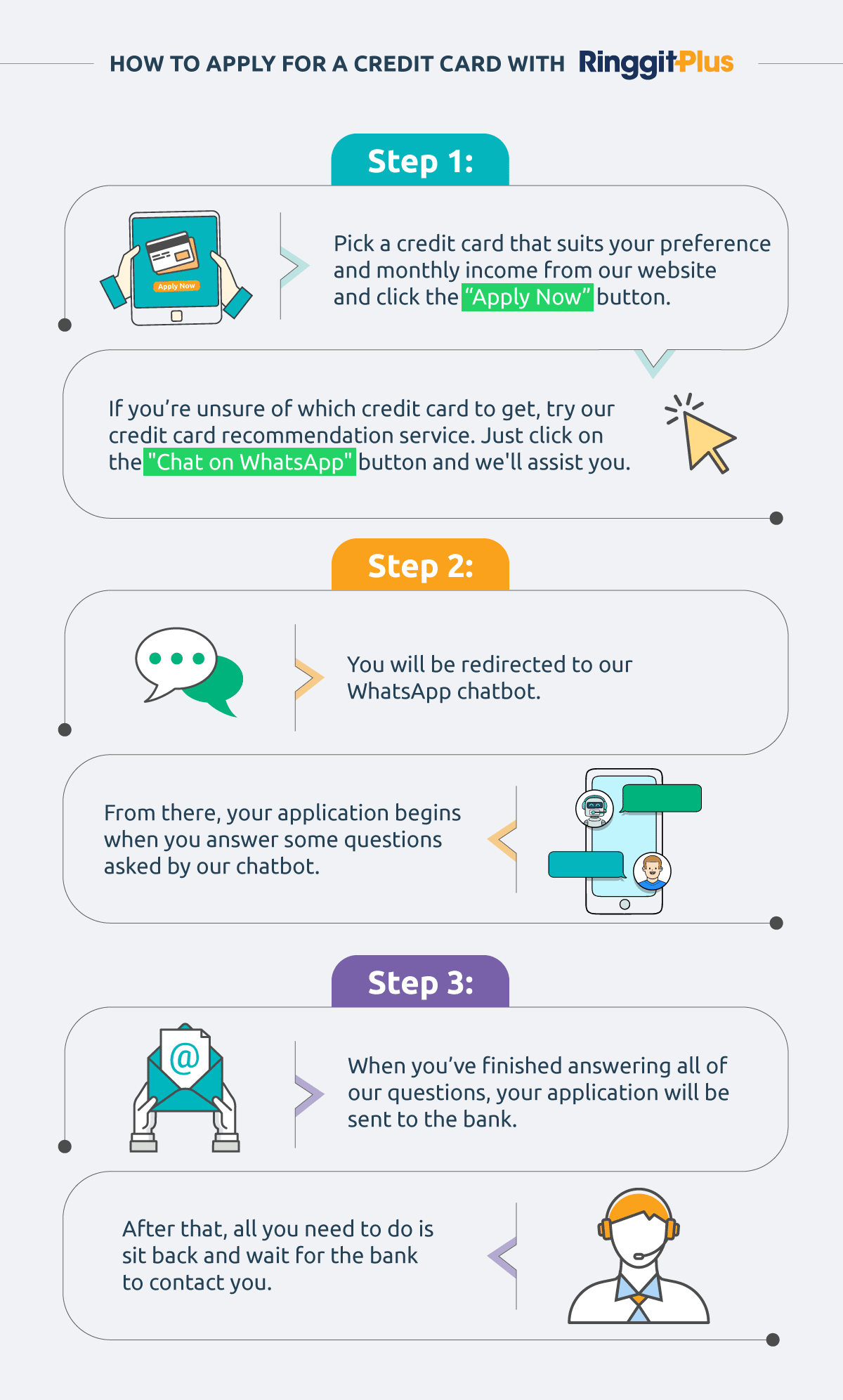

Most definitely! The application steps are simple and you can apply in just 10 minutes or less from the comfort of your home.

We will help check your eligibility so you don’t have to worry about applying for credit cards with low approvals.

Should you have any questions regarding your credit card application, reach out to us at [email protected]. And while you're looking for the best credit cards, don't forget about our weekly flash deals too. You'll get rewarded with high-value gifts just by signing up with us!

Latest credit card promo codes and discounts in Malaysia

Credit cards are useful if you know how to use them wisely. Besides giving you a rewarding spending experience with all the reward points or cash rebates etc. to collect, you can also enjoy numerous ongoing deals, promo codes and discounts at participating merchants all around Malaysia.

In the tables below, you will find the latest deals, discounts, and offers from your favourite credit cards so you can maximise your savings.

Keep a tab on this section as this list will be updated weekly.

[Updated: 20 November 2024]

|

FOOD AND DINING PROMOTION |

|||

| Bank | Merchant | Promotion | Expiry Date |

| Affin Bank | The Hub Coffee Roasters |

10% off on all meals *Valid for any coffee, non-coffee, filter coffee, iced-drip coffee, or lemonade beverages *Stores at The Exchange 106, Taman OUG, Plaza Zurich and DC Mall |

30 Nov 2024 |

| CIMB | Super Saigon Pho Cafe |

RM10 off (Minimum spend RM80) |

31 Dec 2024 |

| HSBC | Madam Kwan's | 15% off total bill (Minimum spend of RM180) *Dine-in at selected outlets only, except outlets at Imago Mall, ITCC Mall, Genting Sky Avenue and Genting Highland Premium Outlets | 31 Dec 2024 |

| Hong Leong Bank | Penyet Express | 30% off (Minimum spend of RM35 in a single receipt) *Valid only on weekdays |

31 Dec 2024 |

| Public Bank | Black Tap Craft Burgers & Shakes | 10% off on food and beverages *Valid for dine-in only *Not valid for public holidays, Father's/Mother's/Valentine's Day *Bill splitting is not allowed *Limited to a maximum of 8 diners per cardmember per receipt |

30 Dec 2024 |

| Standard Chartered | Manten Omakase |

10% off F&B + Complimentary Orange in winter (For Standard Chartered Priority Banking cards) 10% off F&B (For all other Standard Chartered cards) |

1 Dec 2024 |

| UOB | Gordon Ramsay Bar & Grill | 15% off the total dining bill *Valid for UOB Zenith, UOB Visa Infinite, UOB Lady's Solitaire and UOB PRVI Miles Elite Cards *Valid for dine-in and takeaway *Advanced reservation is required *Bill splitting is not allowed |

30 Dec 2024 |

|

ONLINE SHOPPING PROMOTION |

|||

|

Bank |

Merchant | Promotion | Expiry Date |

| Affin Bank | Bull & Rabbit | RM7 off (Minimum spend of RM70 on Balloon & Flower products only) Promo code: AFFIN7 |

31 Dec 2024 |

| Alliance Bank | Christy Ng | 12% off (Minimum spend of RM100) Promo code: 24ALLIANCECN12 |

31 Dec 2024 |

| CIMB | BuySolar | Up to 10% off Solar PV Systems with participating solar service providers: - 5% OFF by GSPARX Sdn Bhd - 5% OFF by Verdant Solar Sdn Bhd - 10% OFF by Brilliant Solar Sdn Bhd - 10% OFF by YongYang Sdn Bhd |

31 Dec 2024 |

| HSBC | Kinohimitsu |

RM20 off on any items (Minimum spend of RM75) |

30 Nov 2024 |

| Public Bank | Watsons | RM20 off every Thursday (Minimum spend of RM200 in a single transaction) *Valid on the Watsons website/app, and limited to the first 200 transactions each Thursday with T&Cs applied |

26 Dec 2024 |

| Standard Chartered | Club21 | 20% off year-long offer Promo code: SBMY20 *Valid for purchases made via https://club21.com/collections/standard-chartered-... |

31 Dec 2024 |

|

HOTEL AND TRAVEL PROMOTION |

|||

| Bank | Merchant | Promotion | Expiry Date |

| Affin Bank | The RuMa Hotel & Residences | 10% off Urban Escape and Suite Temptation Room Promo code: AFFRuMa *Valid for all AFFIN credit cards *Reservations are required |

31 Dec 2024 |

| AmBank | Agoda | 10% off domestic hotel bookings 8% off international hotel bookings *Valid for AmBank Visa credit cards *Valid for hotels with the "Promo Eligible" tag *Other terms may apply Booking period: until 31 December 2025 Stay period: until 31 March 2026 |

31 Dec 2025 |

| CIMB | The Pines Melaka |

10% off the Best Available Rate

Booking and room stay period: until 31 December 2024 Promo code: CIMB-10 |

31 Dec 2024 |

| HSBC | Flow | New Customer RM15 OFF* First booking via https://app.flowtheroom.com or Flow app Promo code: HSBCFTR11 Existing Customer RM5 OFF* on a minimum spending of RM120 via https://app.flowtheroom.com or Flow app Promo code: HSBCFTR23 |

28 Feb 2025 |

| Hong Leong Bank | Agoda |

8% off worldwide hotel bookings via agoda.com/Visamy Stay period: Valid until 31 March 2026 |

31 Dec 2025 |

| Standard Chartered | Lexis Hibiscus, Port Dickson | Up to 15% off the best available rates For Standard Chartered Priority Banking Visa Card Promo code: VISA15 For other Standard Chartered Visa Cards Promo code: VISA10 |

31 Dec 2024 |

| UOB | Hompton By The Beach Penang |

15% off Best Available Rate + 15% off total bill with minimum spend of RM50 at Elementos Tapas & Lounge |

31 Dec 2024 |