Alex Cheong Pui Yin

7th December 2021 - 2 min read

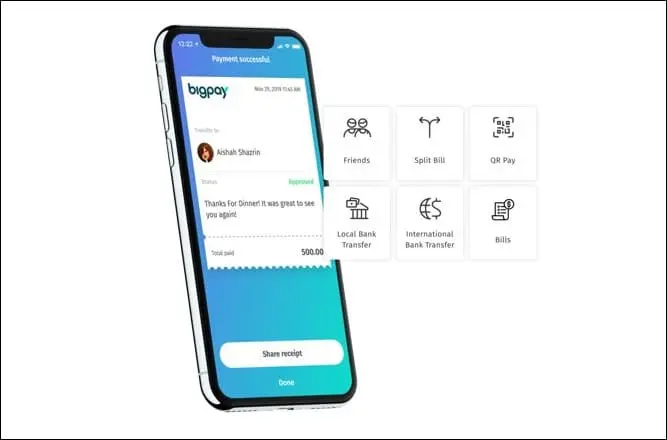

BigPay is making some updates to its user terms, including increasing its wallet size from the current RM10,000 to RM20,000. This is slated to take effect starting from 13 December 2021.

In announcing the update, BigPay clarified via an in-app notification that it has “recently updated our terms and conditions to reflect a couple of cool upgrades to your BigPay app, including a wallet size increase from RM10,000 to RM20,000.” It also promised that there will be no changes to the user’s overall BigPay experience.

With this latest development, BigPay now joins several other e-wallets that are able to offer an upsized RM20,000 wallet limit, including Touch ‘n Go eWallet (Premium tier) and Merchantrade Money. They are, however, still trumped by Lazada Wallet’s balance threshold of RM25,000. Meanwhile, other e-wallets – such as KiplePay, Boost, GrabPay, and ShopeePay – continue to offer wallet limits of RM10,000 and below.

Aside from the increased wallet size, BigPay’s latest amendment to its user terms will also see its total peer-to-peer transfer and withdrawal amount capped at a maximum of RM10,000 per day from mid-December onwards. Currently, BigPay’s peer-to-peer transfer and withdrawal amount are currently set at a daily maximum cap of RM2,000 each.

Other than these, there are no further changes. BigPay’s credit card top up limit also remains unchanged at RM1,000 since its reduction in October 2020.

Comments (2)

rm20k sound alot here in malaysia, indon, vietnam etc

but when go UK europe and USA , not enough for hotel also.

so very troublesome to top up when oversea esp. when using maxis with their rooming charges.

What’s the point to have higher limit but the top up limit is still the same ?