Jacie Tan

18th October 2019 - 9 min read

You’ve booked yourself a holiday and now it’s time for you to purchase your travel insurance policy. Of course, you could just go online and randomly pick an insurance plan – but how do you know whether you’re getting the best value for your money, and whether that plan has all the coverage that you need? Here’s a comprehensive guide on navigating the different travel insurance plans out there and picking the best one for you.

Step 1: Where and when should you buy travel insurance?

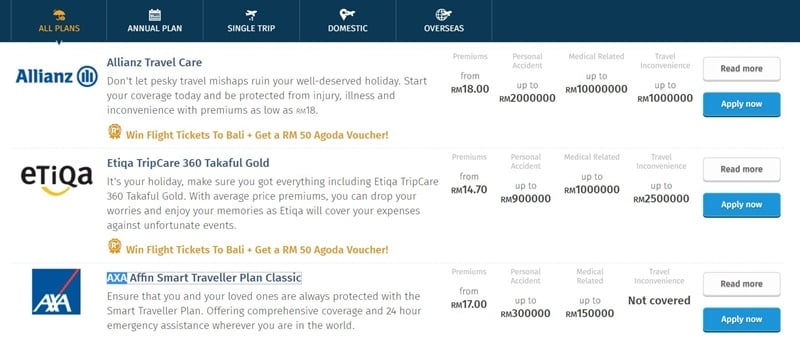

Thanks to the Internet, purchasing travel insurance is really easy. You can even buy travel insurance as an add-on when you book your flight tickets online. If you are familiar with the various travel insurance providers out there, you can visit their respective websites, key in your travel details, and yourself a quotation on the price of the premium. Alternatively, our RinggitPlus website has all the available travel plans in one place, together with details on the premium price and scope of coverage as well.

Last-minute planners will be glad to know that you are able to purchase your travel insurance policy right up until the very day of your departure. However, it’s generally better to make your travel insurance purchase earlier on before your travel dates. For example, AXA Affin Smart Traveller compensates you for travel and accommodation losses arising from serious injury or illness to you or your immediate family – but only if you had bought the plan at least 14 days before your trip.

Step 2: How long is your trip?

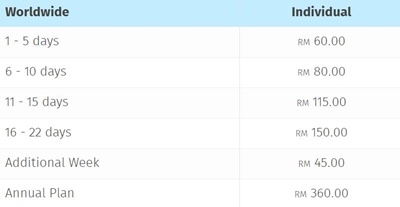

Your policy will cover you from the starting date of your trip to the end, so make sure you get your travel dates right. The duration of your trip is also one of the determining factors of the price of your premium. The longer your trip is, the higher the premium will be. Usually, the price increases in blocks of five days – if your trip is 1-5 days long, you pay a certain price; if it’s 6-10 days long, the premium is slightly higher, and so on.

Most insurance companies allow you to insure a trip for up to 30 days and charge an additional premium for every extra week thereafter. Frequent travellers can consider buying an annual travel insurance policy instead – although you might want to do some calculations beforehand. For example, Allianz Travel Care’s annual plan for worldwide coverage is priced at RM360. You’d have to do more than three 14-day trips in a year to make it more worthwhile to get the annual plan instead of single-trip policies each time.

While you’re making sure your dates are right, don’t forget to ensure that you’ve selected the right location for your coverage as well. For instance, if you’ve purchased Malaysia-only insurance for a trip to Johor Bahru, don’t assume that you will be covered if you make a trip across the causeway to Singapore.

Step 3: Choose your coverage

The main areas of coverage for travel insurance policies are personal accident cover, medical-related coverage, and travel inconveniences. Personal accident cover offers you a payout should accidental death or permanent disability occur to you when you are on your trip. Medical cover allows you to claim for medical expenses, treatment, hospital allowances, and so on. Lastly, travel inconveniences let you claim for lost baggage, missed flights, cancelled trips, and the like.

Almost all travel insurance plans will offer personal accident benefits and some basic medical-related coverage – such as the SOMPO Travel Plus Basic and the Citibank Smart Traveller Classic. The more comprehensive travel insurance policies will also provide for travel inconveniences – like the Chubb First plan, which goes so far as to compensate you for additional costs of boarding your pet should your trip home be delayed. On the other hand, there are also plans like TuneProtect’s Baggage Delay & 1 hour On-time Guarantee Insurance which only cover you for AirAsia flight and baggage delays – and nothing else.

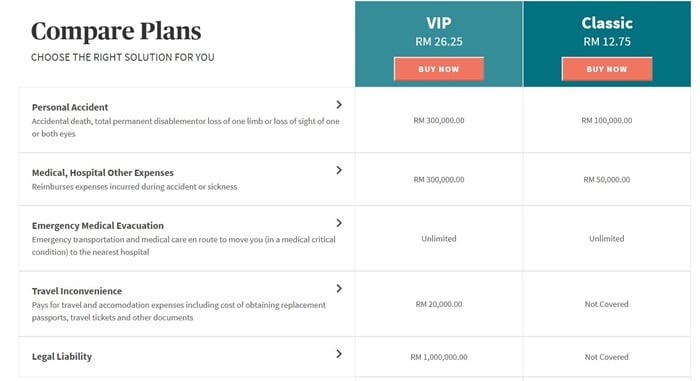

Most insurance policies come in different “tiers” with varying premium prices – and it is the scope and level of coverage that set them apart. The more extensive your insurance coverage is, the pricier your insurance premium will be. It’s a simple case of the more you pay the more you get. Insurance policies with a longer list of coverage also tend to insure you for higher amounts – so you would get a bigger sum should you need to make a claim. For instance, take a look at the difference between AXA Affin’s Smart Traveller VIP plan and its Smart Traveller Classic.

Step 4: Check the definitions, exclusions, and add-ons

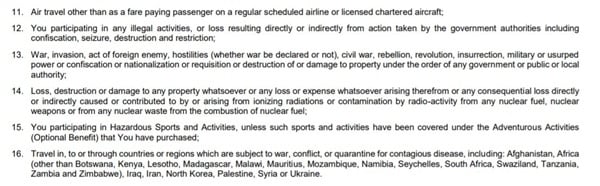

If you want to make a responsible purchase, you should always read the product description and policy wording documents. It may sound tedious, but it’s the only way to know exactly what coverage you are getting for the premium you are paying.

Above is an excerpt from Etiqa’s general exclusions list, as found in its product disclosure sheet. From Clause 15, you are informed that you won’t be covered if you were to participate in what are considered “Hazardous Sports And Activities” – which is also defined further down in the document – except for the sports that will be covered if you purchased the additional Adventurous Activities Optional Benefit together with your main policy.

Step 5: Compare, compare, compare

Once you’ve decided what breadth and depth of coverage you want for your upcoming trip, you should narrow your options down to a handful of suitable policies and then compare their price value. Let’s use an example to show you how best to do it.

Mary is looking for a travel insurance policy for her 6-day trip to India. She wants to be covered for every possible hiccup during her travels, so she looks at the plans that can give her the widest coverage for maximum peace of mind. She has narrowed her options down to these three premium-level plans from three different providers.

| Plan A (RM185/policy) | Plan B (RM89/policy) | Plan C (RM96/policy) |

|

|

|

Mary decides to go with Option B as it has the cheapest premium out of the three – but also because she is satisfied with the breadth of coverage and level of compensation the plan has to offer.

Don’t forget that some plans also allow you to get insured together with your spouse or family members. In most cases, it’s cheaper to do so. For example, if you bought the RHB Travel Protector Plus Supreme (across Asia, 5 days) for yourself and your spouse at RM70, you would save RM8 compared to if you had bought two plans separately for RM39 each.

Step 6: Look for discounts – and use a credit card

Some travel insurance providers do give out discounts when you purchase plans with them online; AXA, Etiqa, and MSIG for instance each offer a 25% instant rebate on their travel insurance policies. And if you buy selected travel insurance plans through RinggitPlus, you can get some sweet deals like a free RM50 Agoda voucher and even a chance to win free flights to Bali.

Another thing you can do to make the most out of your purchase is use the right credit card when buying your insurance plan. For instance, buying your travel insurance online would get you cashback if you used a Public Bank Visa Signature (6%), Standard Chartered JustOne Platinum (0.2-15%), or other cards that offer benefits for online transactions. You should make it a habit to capitalise on your credit card’s benefits either way, but it’s a must especially when you’re buying multiple policies for a group of friends or purchasing an annual plan.

Hopefully, this guide can help you make more informed decisions when it comes to buying a travel insurance plan – getting you more for your money in the process. Remember, you can find all the insurance plans and their respective coverage and premiums all in one place at RinggitPlus.com.

Comments (0)