To maximize credit card benefits in Malaysia, it's essential to understand how to leverage sign-up bonuses, rewards programs, and cashback offers. For first-time applicants, RinggitPlus can guide you through selecting the best cards that match your spending habits and financial goals.

From the latest gadgets to cash vouchers to free luggage, these are just some of the credit card gifts that could be yours when you sign up for a credit card with RinggitPlus.

At RinggitPlus, we compare the latest sign-up offers so you can get the most cashback, air miles, shopping rewards, or exclusive freebies when you apply. Our RinggitPlus credit card promotion runs every week, so go ahead and bookmark this page so that you don't miss out on all the great credit card deals.

Without further ado, we bring you this week's lineups for our credit card promotion below.

|

Sign Up Gift

|

RM800 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who have applied for the HSBC Visa Signature Credit Card)

RM500 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who have applied for the HSBC Live+ Credit Card and HSBC TravelOne Credit Card)

RM150 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who have applied for the HSBC Platinum Credit Card)

RM50 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who have applied for the HSBC Amanah MPower Platinum Credit Card-i)

|

|

Sign Up Period

|

11 June 2025 - 13 June 2025

|

|

Requirement

|

For the HSBC Live+ Credit Card, HSBC Visa Signature and HSBC TravelOne Credit Card

Apply, get approved by HSBC, activate the new card, and subsequently spend a minimum of RM1,000 in retail transactions within 60 days of the card approval date.

For the HSBC Platinum Credit Card and HSBC Amanah MPower Platinum Credit Card-i

Apply, get approved by HSBC, activate the new card, and subsequently spend a minimum of RM500 in retail transactions within 60 days. You must also perform 5 e-wallet top-ups within 60 days of the card approval date.

|

|

Eligible Card

|

HSBC Visa Signature Credit Card

HSBC TravelOne Credit Card

HSBC Live+ Credit Card

HSBC Platinum Credit Card

HSBC Amanah MPower Platinum Credit Card-i

|

|

Eligible Applicant

|

New customers only.

Existing primary cardholders, those who have their HSBC credit card(s) application approved or denied within 6 months, and those who have cancelled their HSBC credit card(s) within 6 months before the date of the flash deal application

are not eligible.

Terms and conditions apply.

|

|

Sign Up Gift

|

RM3,500 Touch 'n Go E-Wallet Credit (For every 38th qualified applicant based on the Qualified Applicants list from the Bank, capped at 3 units)

RM500 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who apply for the UOB Zenith Card, UOB Visa Infinite Card, UOB PRVI Miles Elite Card, UOB PRVI Miles Card, UOB World Card, UOB Lady's Solitaire Card, and UOB Platinum Business Card)

RM400 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who apply for the UOB Preferred Card, UOB Lady's Card, UOB ONE Card, UOB EVOL Card, Lazada UOB Card, and UOB Simple Card)

|

|

Sign Up Period

|

9 June 2025 - 16 June 2025

|

|

Requirement

|

For UOB Zenith Card, UOB Visa Infinite Card, UOB PRVI Miles Elite Card, UOB PRVI Miles Card, UOB World Card, UOB Lady's Solitaire Card, and UOB Platinum Business Card

Apply for and get approved by UOB, subsequently activate the new card, and make a minimum of RM1,000 in retail transactions within 60 days from the approval date.

For UOB Preferred Card, UOB Lady's Card, UOB ONE Card, UOB EVOL Card, Lazada UOB Card, and UOB Simple Card

Apply for and get approved by UOB, subsequently activate the new card, and make a minimum of RM600 in retail transactions within 60 days from the approval date.

|

|

Eligible Card

|

UOB EVOL Card

UOB Simple Card

UOB PRVI Miles Card

UOB ONE Card

UOB Preferred Card

UOB Lady's Card

UOB Lady's Solitaire Card

UOB Visa Infinite Card

UOB World Card

Lazada UOB Card

UOB PRVI Miles Elite Card

UOB Zenith Card

UOB Platinum Business Card

|

|

Eligible Applicant

|

New customers only.

Existing cardholders or those who have cancelled their UOB credit card(s) within 12 months before the date of the flash deal application

are not eligible.

Terms and conditions apply.

|

|

Sign Up Gift

|

RM3,800 Touch 'n Go E-Wallet Credit (Performed minimum monthly Eligible Retail Spend of RM20,000 per month for 3 consecutive months from Card Approval Date)

RM1,800 Touch 'n Go E-Wallet Credit (Performed minimum monthly Eligible Retail Spend of RM10,000 per month for 3 consecutive months from Card Approval Date)

RM600 Touch 'n Go E-Wallet Credit (Performed minimum monthly Eligible Retail Spend of RM3,000 per month for 3 consecutive months from Card Approval Date)

RM200 Touch 'n Go E-Wallet Credit (Performed minimum monthly Eligible Retail Spend of RM1,500 per month for 3 consecutive months from Card Approval Date)

|

|

Sign Up Period

|

11 June 2025 - 24 June 2025

|

|

Requirement

|

Apply and get approved by Alliance Bank. Activate the card and make a minimum retail transaction spend per the above criteria to be eligible.

|

|

Eligible Card

|

Alliance Bank Visa Platinum Credit Card

Alliance Bank Visa Signature Credit Card

Alliance Bank Visa Infinite Credit Card

Alliance Bank Visa Virtual Credit Card

|

|

Eligible Applicant

|

New customers only.

Existing primary cardholders of an Alliance Bank Visa or Mastercard Credit Card and those who have cancelled any of their credit cards issued by the Bank

are not eligible.

Terms and conditions apply.

|

|

Sign Up Gift

|

RM5,000 Touch 'n Go E-Wallet Credit (For one (1) Random Winner per week based on the Approval List from the Bank, capped at 3 units)

RM400 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who have two (2) approved RHB credit card applications)

RM300 Touch 'n Go E-Wallet Credit (Guaranteed to qualified applicants who are not selected to receive the gifts mentioned above)

|

|

Sign Up Period

|

9 June 2025 - 30 June 2025

|

|

Requirement

|

For applicants who apply for one (1) RHB Credit Card

Get approved, activate your new RHB credit card, and subsequently make one (1) retail transaction with no minimum purchase amount as a Principal cardholder, within 60 days of the card's approval date.

For applicants who apply for two (2) RHB Credit Cards

Get approved, activate your new RHB credit cards, and subsequently make one (1) retail transaction on BOTH the cards with no minimum purchase amount as a Principal cardholder, within 60 days of the card's approval date.

|

|

Eligible Card

|

RHB Visa Infinite

RHB Visa Signature

MyEG-RHB Credit Card

RHB World MasterCard Credit Card

RHB World MasterCard Credit Card-i

RHB Cash Back Visa Credit Card

RHB Cash Back MasterCard Credit Card

RHB Islamic Cash Back Credit Card-i

RHB Rewards Visa Credit Card

RHB Rewards MasterCard Credit Card

RHB Rewards Visa Credit Card-i

RHB Rewards Motion Code Credit Card

RHB Islamic Rewards Motion Code Credit Card-i

RHB Shell Visa Credit Card

RHB Shell Visa Credit Card-i

|

|

Eligible Applicant

|

New customers only.

Existing principal cardholders and those who have cancelled their RHB credit card within 12 months from the date of the current application

are not eligible.

Terms and conditions apply.

|

Credit Card Free Gift and Sign-Up Offer FAQs:

Read the FAQs below to increase your chances of getting a gift with a credit card application on RinggitPlus.

What can I do to get a gift?

You can get a gift simply by applying for a qualifying credit card online with us. There are several participating banks that you can apply to like the following.

Once you have compared and chosen the best credit card that suits your preferences and needs, you can hit the Apply button above to proceed with the credit card application.

How can I get the best credit card sign-up offers?

Banks regularly update their promotions with cashback, vouchers, and exclusive gifts—but not all offers are the same.

1. Compare and Choose the Right Credit Card - Each bank offers different rewards, from cashback and air miles to shopping vouchers. RinggitPlus compiles these deals in one place, so you can easily compare and pick the best card based on your spending habits.

2. Unlock Exclusive Rewards with Sign-Up Bonuses - Most credit cards come with a welcome gift, but they often require you to meet a

minimum spend within 60–90 days. Always check the terms to ensure you qualify for the reward.

3. Save More with Annual Fee Waiver - Some credit cards charge annual fees, while others offer first-year or lifetime fee waivers when you meet spending criteria. Choosing the right card can help you avoid unnecessary costs.

4. Apply Through RinggitPlus for Extra Perks - When you apply via RinggitPlus, you may get exclusive deal such as bonus gift—offers you won’t find when applying directly through banks.

Is the gift guaranteed or subject to further selection?

This will be dependent on each of the participating banks' terms and conditions. Some banks offer guaranteed sign-up gifts to all successful applicants, while some may provide sign-up gifts to several successful applicants.

In essence, the sign-up gift will be given to successful applicants who have

- Chosen and applied for a qualifying credit card via RinggitPlus

- Follow the instructions stated in the Welcome Email (which you will get in your inbox once you click the Apply button to start the application) to complete your application with the bank

- Follow the requirements and processes of the bank, and

- Get approved by the bank

Once approved, you will have to fulfil a few requirements to qualify for the sign-up gift. This can include hitting a certain spending amount or activating the credit card within a stipulated time upon the credit card approval date, depending on the bank's T&C.

How long does it take for my credit card to be approved?

Your credit card application may take several business days to be approved by the respective bank. We've compiled detailed FAQs, so do

check it out.

If you wish to speed up the process, just make sure you complete your submission along with the required documents such as a copy of your IC, your latest salary slips etc. Don't miss any of it!

Note that RinggitPlus is not involved in the process of credit card approvals as this will be done solely by the bank. Hence, you may also call the respective bank to check your credit card application status.

I have received my credit card. How do I activate it?

The steps to activate your credit card vary from one bank to another. But in most cases where your approved credit card has been delivered to you, the respective bank should provide you with instructions in the letter that you got together with your credit card.

The bank also may email you the instructions on how to activate your credit card. So be sure to check your inbox from time to time!

Otherwise, you can always call the bank to find out the steps to activate your credit card.

What does retail spending mean in the RinggitPlus flash deal T&Cs?

Retail spending typically refers to domestic and overseas purchases, online transactions, e-wallet reloads (such as Touch and Go, BigPay, or Boost), standing orders, non-online auto-billing, and payments for insurance or takaful.

It excludes cash advances, balance transfers, instalment payments, quasi-cash transactions, refunds, contested or fraudulent transactions, payments to charity, utility and government-related payments, and other fees or charges such as interest, late fees, yearly fees, or service costs.

Please note that the definition of retail spending may differ based on the terms and conditions of the issuing bank. Do comb through the T&Cs to find more details or contact us at

can@ringgitplus.com!

My credit card is activated and I have completed the requirements to qualify for the sign-up gift. How can I redeem my gift?

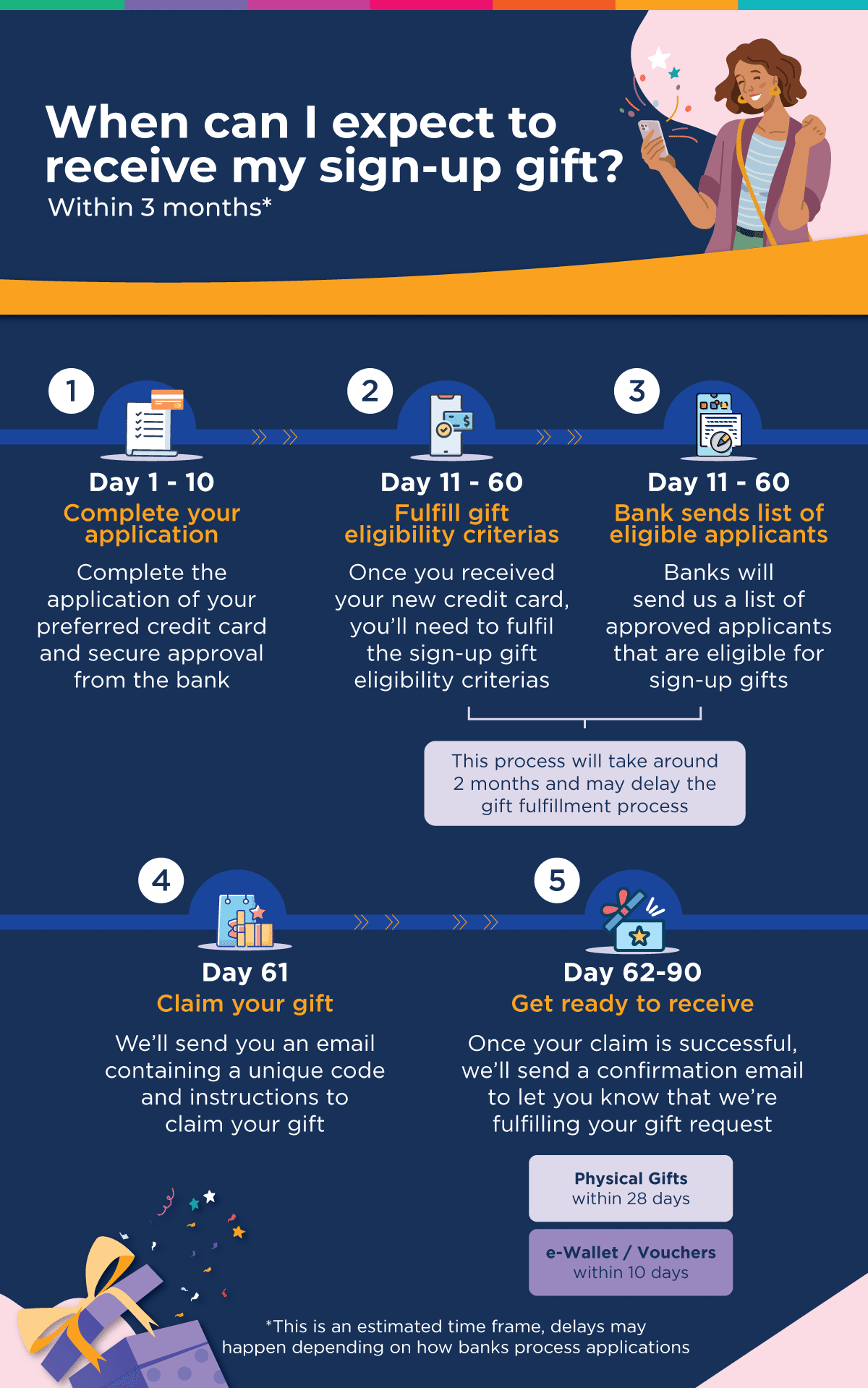

Each bank that we are partnering with will send us a list of approved applications that have met all the gift redemption requirements. Note that this process can take around two months.

After that, if you are eligible for a sign-up gift, you will receive a gift redemption email from us with a dedicated code and instructions on how to redeem your gift.

Please find more comprehensive FAQs about our gift redemption process

here.

How can I reach out to you for more information or assistance?

If you have any questions regarding your gift redemption or anything related to your credit card application, please get in touch with us via email at

can@ringgitplus.com. We're happy to help!